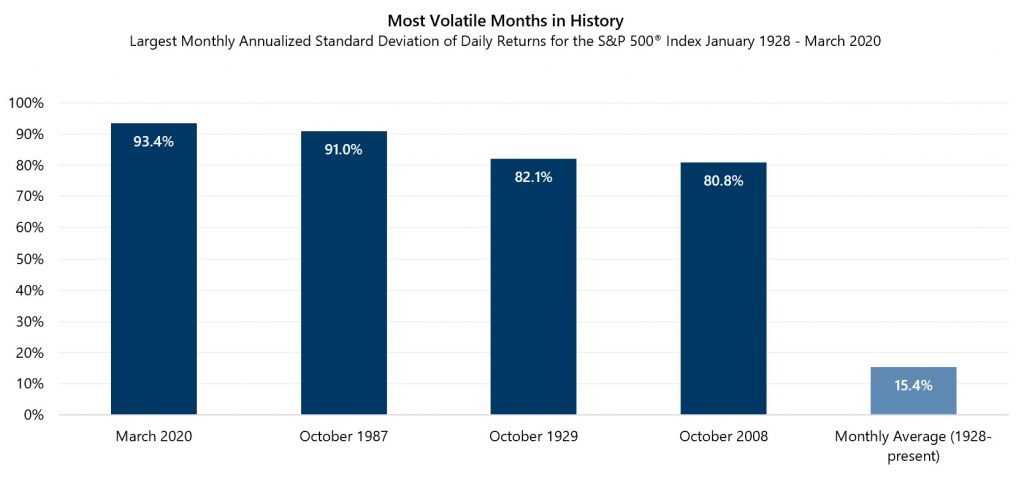

Measures taken to prevent the spread of COVID-19 have caused radical changes to our everyday lives. We have had to adjust how we work, play, shop, eat and travel. Naturally, the restrictions on these activities will have a significant and negative impact on overall economic activity. This impact was reflected in equity market action in the first quarter of 2020. The first quarter witnessed not only the quickest-ever bear market decline, but also the most volatile month in stock market history. The standard deviation of daily returns for the S&P 500® Index in March 2020 was higher than any point in history, including the Great Depression, October 1987 and the financial crisis of 2008.

Are extreme volatility spikes harbingers of tough economic times to come? Not necessarily. The second-most volatile month in history was October 1987. It did not pre-sage economic doom nor the beginning of a protracted equity bear market. In early December 1987, the market started a steady recovery from its Black Monday losses and reached new all-time highs by July 1989. The U.S. economic expansion that began in November 1982 was not interrupted and the next recession did not begin until July 1990.

Rather than being predictive of future outcomes for the equity market and economy, extreme volatility measures are more likely reflective of the kind of uncertainty that makes investment decision-making challenging. In the investment arena, uncertainty and risk are related, but distinct. In crisis environments, volatility becomes a crude measuring stick that encompasses both.

Risk is present when the range of outcomes is known and probabilities can be estimated. Wagering on a game of dice is risky, but odds can be calculated and bets can be sized to fit the likelihood of a favorable outcome. Uncertainty, on the other hand, is suspecting the dice are loaded.

Similarly, wagering on the next card to be drawn from a deck of playing cards is risky but, under the right conditions, information underlying the game improves over time. Knowing what cards have already been drawn from the deck improves the odds of correctly guessing subsequent cards. However, if the deck of cards is non-standard or consists of an undisclosed number of standard decks, players cannot get an accurate calculation of the odds. A game with these conditions is not merely risky, its outcomes are completely uncertain and only a foolish person would participate.

The unprecedented social distancing measures taken in response to the pandemic changed the nature of valuing investments. Investing is always risky, and social distancing measures (and the degree to which they are adhered to) have created a wider range of outcomes for the economy, the market and individual companies than existed prior to the outbreak. On top of that, investing became uncertain, more like a game of dice or cards in which the odds cannot be calculated, because the current circumstances are unprecedented. Parameters for estimating the probability of specific outcomes simply did not exist when policies to slow the spread of the pandemic were put in place.

As time passes, uncertainty may decrease, but risk will remain. Knowing that policymakers can respond promptly with policy countermeasures like stimulus bills and monetary action removes some uncertainty. The effectiveness of countermeasures can be tracked, evaluated and modeled, which is how risk is managed – not eliminated, but managed. The spread of the disease has been frighteningly fast, and infection and fatality rates have differed by location, but the mere fact that a growing data set exists means uncertainty has been reduced and information exists to manage the risks of the pandemic. Healthcare workers, policymakers and investors increasingly have the ability to act based on real information to reduce the risk of adverse outcomes and increase the likelihood of positive outcomes. As the amount of information on the current state of the world increases, uncertainty is removed but risk will persist. Equity markets may remain susceptible to sharp spikes in volatility – particularly if there is severe and unexpected deterioration in statistics relating to the spread of the pandemic, fatality rates and economic activity.

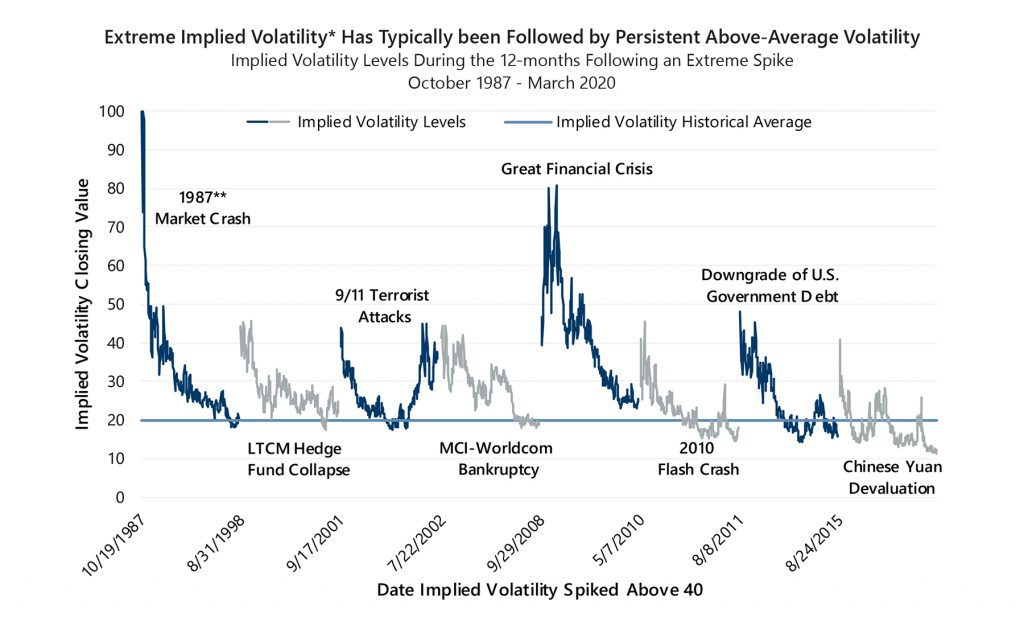

Equity markets have recovered from the losses incurred during volatile periods of the past — sometimes quickly, sometimes slowly. While the future path of the equity market remains uncertain, history suggests that after reaching extreme highs, volatility measures can persist at above-average levels for lengthy periods of time, regardless of market direction. Examining periods following months in which the annualized standard deviation of daily returns for the equity market exceeded 50% shows that realized volatility remained above average for most of the subsequent year, and in some cases much longer, as was the case during volatility spikes associated with the Great Depression and the more recent financial crisis of 2008. Implied volatility, which has been priced since 1985, shows a similar pattern. When implied volatility has spiked above 40 in the past, daily closing values have typically remained above average for most of the subsequent year.

*Implied volatility levels displayed are a combination of the Cboe® S&P 100 Volatility Index® (the VXO®) and the Cboe® Volatility Index® (the VIX®). Daily pricing for the VIX® is available from January 2, 1990 to present. VXO® prices are used for dates prior to 1990. **Graph is truncated for readability. The VXO® was priced at 150.19 on Black Monday, October 19, 1987. Source: Bloomberg, L.P.

History suggests that equity market volatility will subside over time. First, as the world becomes less uncertain, the component of market volatility associated with uncertainty will diminish. What remains in the near-term is a higher level of risk, reflecting the grim realities of the pandemic. In time, the risks posed by the pandemic will be managed down as healthcare providers and health policymakers treat the disease and slow its spread. The history of market crises suggest that equity market volatility may also decline as progress is made. At the same time, economic and financial policymakers will have more information and more tools to manage the economic fallout of the pandemic, and investors will have more information to manage the specific risks to which they are sensitive. How long this process will take is unknown. Progress will be made, but the pace will vary and there will likely be setbacks along the way.

Strategies that combine equity market exposure with index option writing may be an attractive solution for investors who need to stay positioned for long-term growth or need a lower risk means of earning back equity market losses. With risk elevated and likely to stay that way for a while, investors may benefit from reliable risk reduction and downside protection. Gateway’s index-option based approach to managing risk and pursuing return has a history of generating higher cash flow in periods of elevated equity market volatility. Higher cash flow helps position Gateway strategies for attractive participation in an equity market recovery, but also provides the potential for robust downside protection should additional market declines lie ahead. In this uncertain time, investors can rely on Gateway to stick with the discipline it has maintained for over 40 years.

*For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.