-

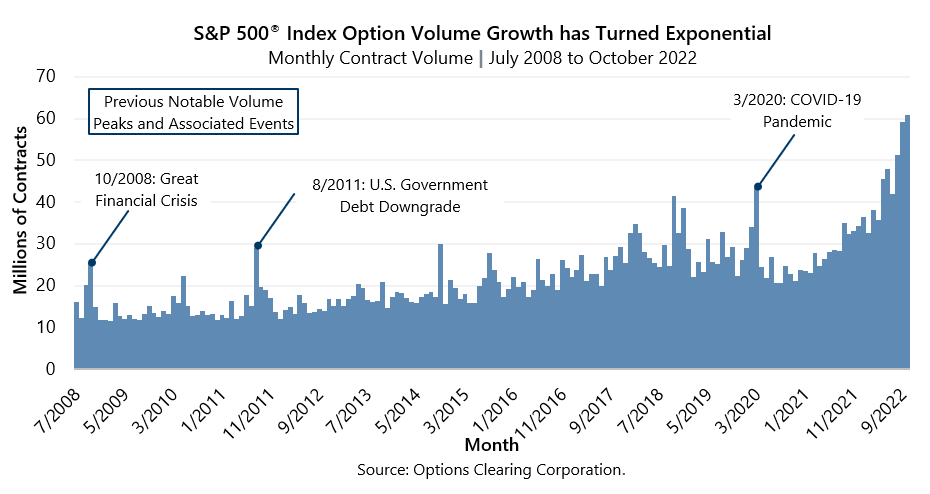

- 66% higher than volume for January 2022

- 111% higher than average monthly volume for 2021

- 88% higher than volume for October 2021

- 40% higher than volume for March 2020 – which stood as the highest monthly volume before this year

As much as half of October’s record volume may have been due to activity in “zero days to expiration” (0DTE) strategies. There has been significant growth in 0DTE strategies, ultra-short-term S&P 500® Index option trading. Specifically, trades in index options that have one-day or less until they expire have increased from approximately 30% of daily trading volume at the beginning of the year to over 50% for most of the third quarter of 2022.

The potential market impact of 0DTE is a double-sided coin. On one side, index option strategies may be exacerbating the market’s tendency to have significant price swings during bear markets and other periods of uncertainty. On the other side, large price swings are contributing to elevated implied volatility and, therefore, elevated index option premiums, which can be a benefit to strategies that generate option-writing cash flow.

For more Perspective, see “Is the Index Option Market Creating Volatility?”

*For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.