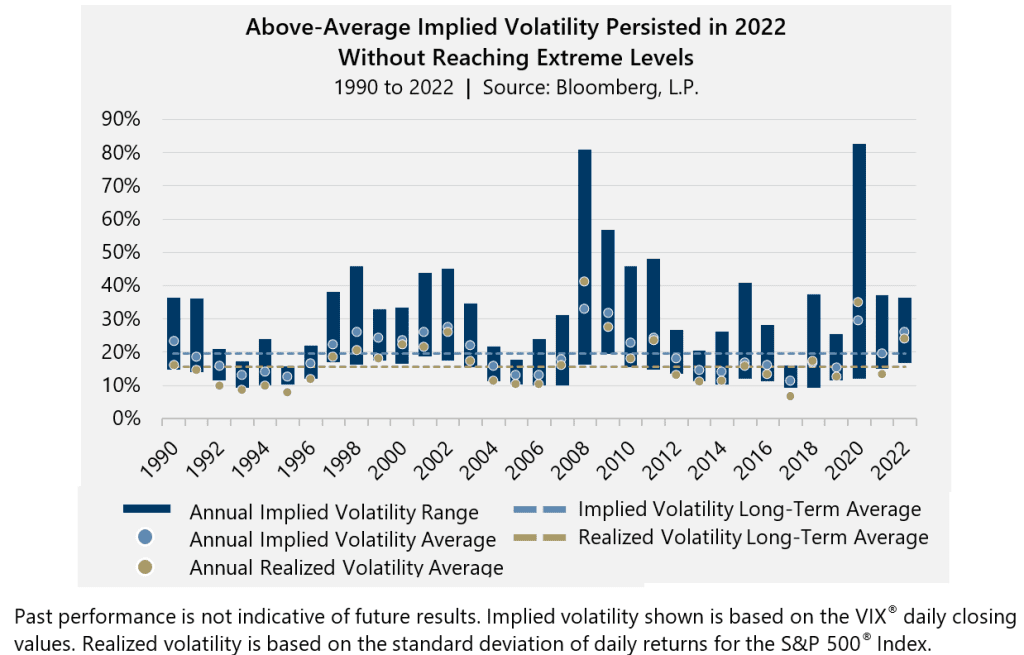

As investors weighed monetary policy risks and other risk factors including the conflict in Ukraine and China’s Zero-COVID policy, demand for index options was strong over the course of the year, setting records for trading volume and open interest. This, combined with high realized volatility, kept implied volatility elevated in 2022.

The 25.64 average level for the Cboe® Volatility Index (the VIX®) in 2022 is notable for multiple reasons:

- it is 30% higher than the average VIX® level since its 1990 inception

- it is the sixth-highest yearly average

- every year with a higher average included a volatility spike that brought the VIX® to at least 40 (conversely, the 2022 average is the highest for all years in which the VIX® remained below 40)

In other words, implied volatility was persistently well-above-average without ever reaching extreme levels, a rare pattern in the history of implied volatility.

In fact, the VIX® had a higher percentage of days with readings in the 25 to 30 range than any year except 1999, another year that included multiple rate hikes and persistently above average implied volatility.

Many of the risk factors that drove volatility in 2022 remain unresolved, which may keep implied volatility elevated in 2023. Elevated implied volatility combined with higher interest rates, is beneficial for option writing premiums.

Past performance is not indicative of future results. Source: Bloomberg, L.P.

*For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.