As traders and professional prognosticators hang on every word from Federal Reserve officials, anticipate each data release with tense fingers hovering over keyboards and debate the odds of “hard landing,” “soft landing” or, the most-optimistic scenario of “no landing,” the unspoken questions behind all the agita are: Is the market through the worst of it, or is there more trouble ahead? Is 2023 going to be like 1963 or 2002?

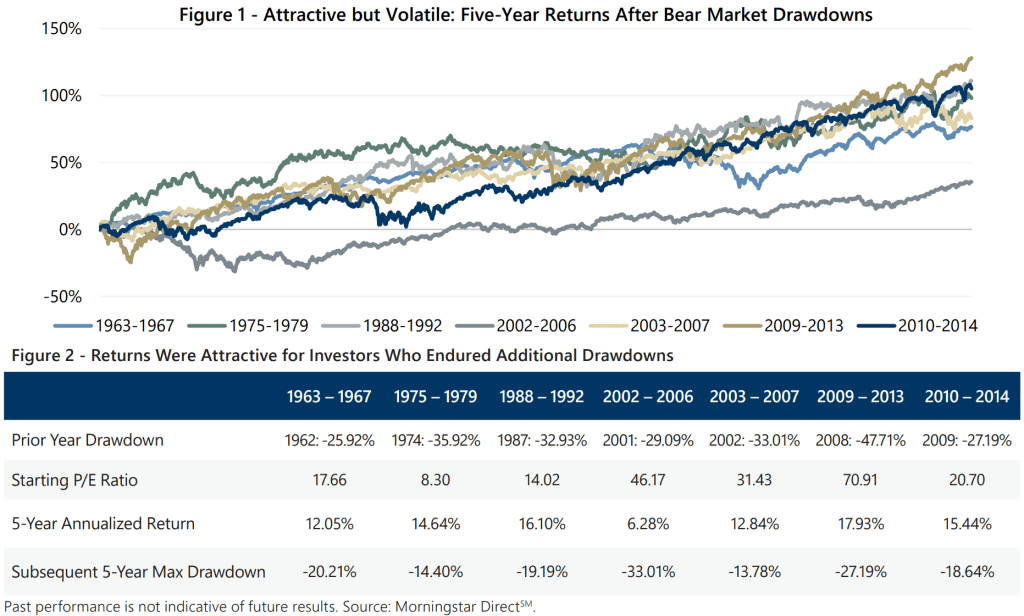

The good news for long-term investors is that many recent drivers of short-term market swings may not matter over their time horizons. As Figures 1 and 2 show, long-term equity returns after years like 2022 are attractive but volatile: Five-year periods after bear market drawdowns produced double-digit annualized returns in six out of seven instances since 1950. Annualized returns ranged from 6.28% to 17.93%. However, all five-year periods included additional double-digit drawdowns including three instances of drawdowns exceeding 20%.

Given the bond market’s recent propensity to deliver losses with higher frequency and higher correlation to equity market losses, investors who seek a smoother ride than the equity market may be looking for alternatives to bonds for risk reduction – especially since the total return potential of bond portfolios remains relatively low as yields on intermediate- to long-term bonds remain at levels that would accurately be described as “historically low” at any point in history outside of the past 10 years.

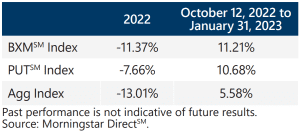

Index option-writing strategies with a low volatility profile may be compelling alternatives. For example, the Cboe® S&P 500 BuyWriteSM Index (the BXMSM) and the Cboe® S&P 500 PutWriteSM Index (the PUTSM) posted smaller losses than both the S&P 500® Index and the Bloomberg U.S. Aggregate Bond Index (the Agg) in 2022. Moreover, the BXMSM and the PUTSM have both generated much higher returns than the Agg since the equity market put in its 2022 low on October 12.

Index option-writing strategies with a low volatility profile may be compelling alternatives. For example, the Cboe® S&P 500 BuyWriteSM Index (the BXMSM) and the Cboe® S&P 500 PutWriteSM Index (the PUTSM) posted smaller losses than both the S&P 500® Index and the Bloomberg U.S. Aggregate Bond Index (the Agg) in 2022. Moreover, the BXMSM and the PUTSM have both generated much higher returns than the Agg since the equity market put in its 2022 low on October 12.

Utilizing index options for risk reduction and risk-adjusted return enhancement may appeal to risk-averse long-term investors who are no longer satisfied with what the bond market has to offer. Low-volatility equity strategies that rely on cash flow from index option selling to both mitigate equity market losses as well as participate in equity market advances, like those managed by Gateway since 1977, may be a suitable alternative for investors who want to reduce their exposure to bonds without increasing overall portfolio risk.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.