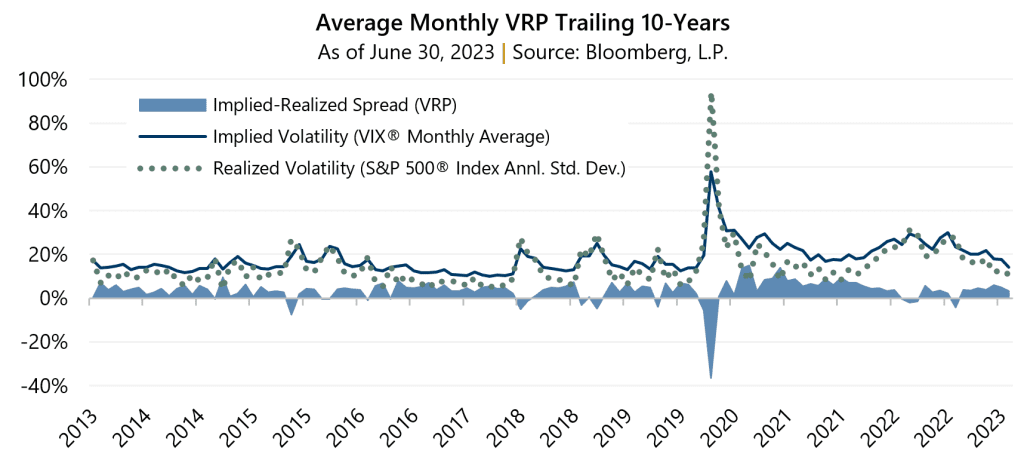

Implied volatility levels declined during the second quarter, primarily during the month of June, as measured by the Cboe® Volatility Index (the VIX®), averaging 16.44. Realized volatility (measured by the standard deviation of daily returns for the S&P 500® Index) also declined with an average of 11.88% during the period. The Volatility Risk Premium (VRP), or the difference between implied and realized volatility, continued to be strong at 4.56%, exceeding its quarterly average since 1990 of 3.63%.

The U.S. Federal Reserve (the Fed) delivered a pause to its recent interest rate hiking cycle and investors took relief to drive equity markets higher and volatility lower during the second quarter of 2023. However, one should beware of complacency. The path of monetary policy remains unclear, war grinds on in Europe and geopolitical tensions seem to be rising around the globe. Interest rates may continue to churn upward just as the labor market begins showing signs of softening. Although potentially supportive of a less hawkish path forward for the Fed, the backdrop does not suggest a less uncertain future. Dwindling odds of returning to the low-inflation, low-rate environment of a recent, but bygone, era are becoming more clear.

While volatility levels have recently declined, they remain elevated compared to those that persisted during the recent quantitative easing era. During the prior 10 years ended in June 2023, the VRP averaged 3.46%. This period included a highly accommodative Fed that endured until 2020. From June 2013 to June 2020, the VRP averaged 2.67%. However, as the world has rapidly changed, so has volatility. From June 2020 to June 2023, the VRP average nearly doubled to 5.32%.

Gateway has historically helped investors navigate through markets during periods of unexpectedly high volatility and periods of unexpectedly low volatility. While Gateway’s strategies benefit from a positive VRP, which is the case 89% of the time, the active and disciplined approach has successfully maintained consistent market exposure and risk profile during periods of low or negative VRP (i.e., when realized volatility exceed implied volatility). Whatever the balance of 2023 may bring, Gateway remains committed to its steady approach that has, since 1977, assisted clients in their pursuit of long-term returns with lower risk than the equity market.

Past performance does not guarantee future results.