Participation and Defense

Investors chase various goals, but often diversification is key and high atop minds amid the current stock-bond correlation conundrum. Equity diversification can be improved in many ways, such as tracking a broad-based index or focusing on a diversified factor. In a factor-based approach, many investors tend to focus on just two categories: growth and value. However, there is continuous debate as to which category is better over the long-term. One factor that has worked well but gets less attention than it deserves is quality.

Quality companies tend to have strong profitability, strong return on equity and assets, and cash flow generation as well as strong balance sheets. These stocks often enable broad market participation while maintaining the potential for defense and may benefit from rising markets or provide protection during times of uncertainty.

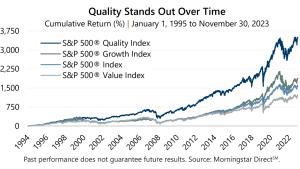

Improved Outcomes Over Time While the past does not predict the future, quality performance over the last 28 years has been very compelling. From January 1, 1995 through November 30, 2023, the S&P 500® Quality Index outperformed not only the broad-based S&P 500® Index but also the S&P 500® Growth Index and the S&P 500® Value Index. For the period, the S&P 500® Quality Index had an average annualized return of 13.17% versus 10.33% for the broader S&P 500® Index, 10.86% for the S&P 500® Growth Index, and 9.37% for the S&P 500® Value Index.

While the past does not predict the future, quality performance over the last 28 years has been very compelling. From January 1, 1995 through November 30, 2023, the S&P 500® Quality Index outperformed not only the broad-based S&P 500® Index but also the S&P 500® Growth Index and the S&P 500® Value Index. For the period, the S&P 500® Quality Index had an average annualized return of 13.17% versus 10.33% for the broader S&P 500® Index, 10.86% for the S&P 500® Growth Index, and 9.37% for the S&P 500® Value Index.

Moreover, the S&P 500® Quality Index has achieved long-term outperformance with lower overall risk compared to the other three indices. The standard deviation of monthly returns for January 1, 1995 through November 30, 2023 was 14.29% for the S&P 500® Quality Index compared to 15.34% for the broader S&P 500® Index, 16.16% for S&P 500® Growth Index, and 15.84% for S&P 500® Value Index.

Holding Up Through Any Weather

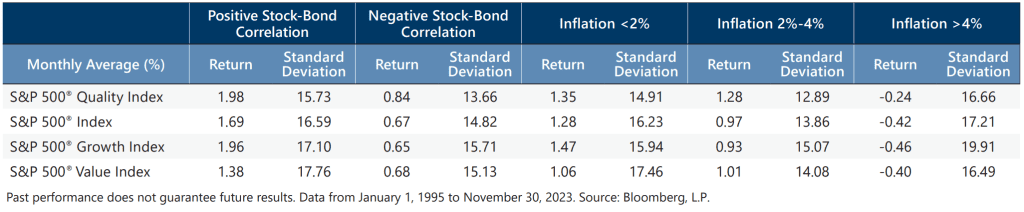

Global markets have experienced significant changes in recent years. For instance, investors have navigated record inflation and – as a recent Perspective explores – the potential for a sustained period of positive correlation between stocks and long-term bonds. Times have certainly changed when compared to the prior decade or more of quantitative easing.

Regardless of inflation or correlation between stocks and bonds, quality has regularly delivered relatively robust average monthly returns with lower risk than the broad market, growth or value factors. Below, data from the January 1, 1995 inception of the S&P 500® Quality Index shows the quality factor shining through periods of positive and negative stock-bond correlation as well as low, moderate, and high inflation regimes through November 30, 2023.

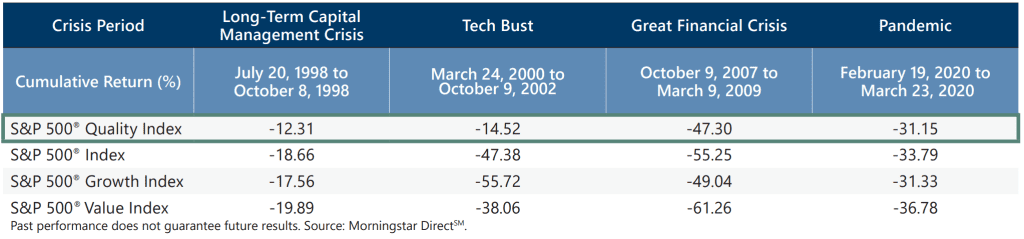

The quality factor can prove beneficial during rising markets but also offer protection during periods of uncertainty or market stress. The quality factor exhibits defensive characteristics, adding a layer of portfolio protection provided by durable businesses with a history of withstanding full economic cycles.

By emphasizing quality within an equity portfolio, investors can harness the benefits of healthy firms exhibiting high-profitability, fortress balance sheets, and strong fundamentals. The consistent application of a disciplined, active investment management process backed by an extensively experienced team can also add value for investors and improve outcomes in all environments. Since 1977, Gateway has developed a distinct expertise in quantitatively driven equity portfolio management and index option-based investing offering a suite of products with the potential to mitigate risk and enhance risk-adjusted return.

Past Performance does not guarantee future results

Data sources: Bloomberg, L.P. and Morningstar DirectSM.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.