Latest Seasonal Trends

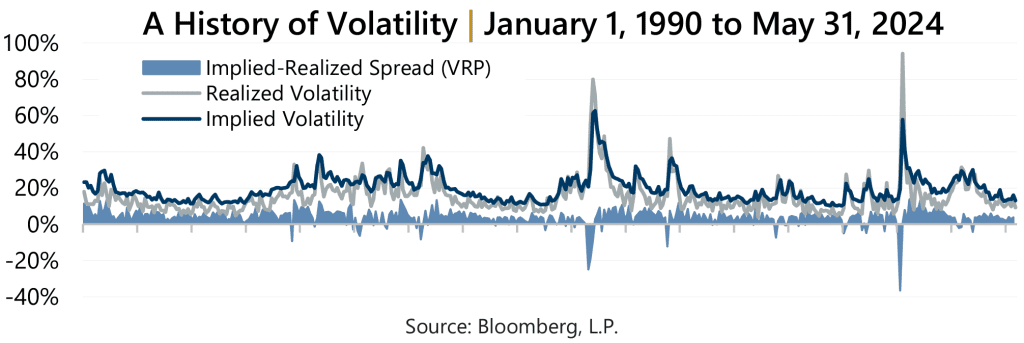

Spring has turned to summer and offers a chance to sit back, unwind, and find even the smallest escapes from the routines of the year. Just like this natural seasonality, there can be seasonal tendencies within the stock market – specifically market volatility. During the summer months of June, July, and August, both realized and implied volatility can often (though not always) be known for getting stuck in a bit of a lull.

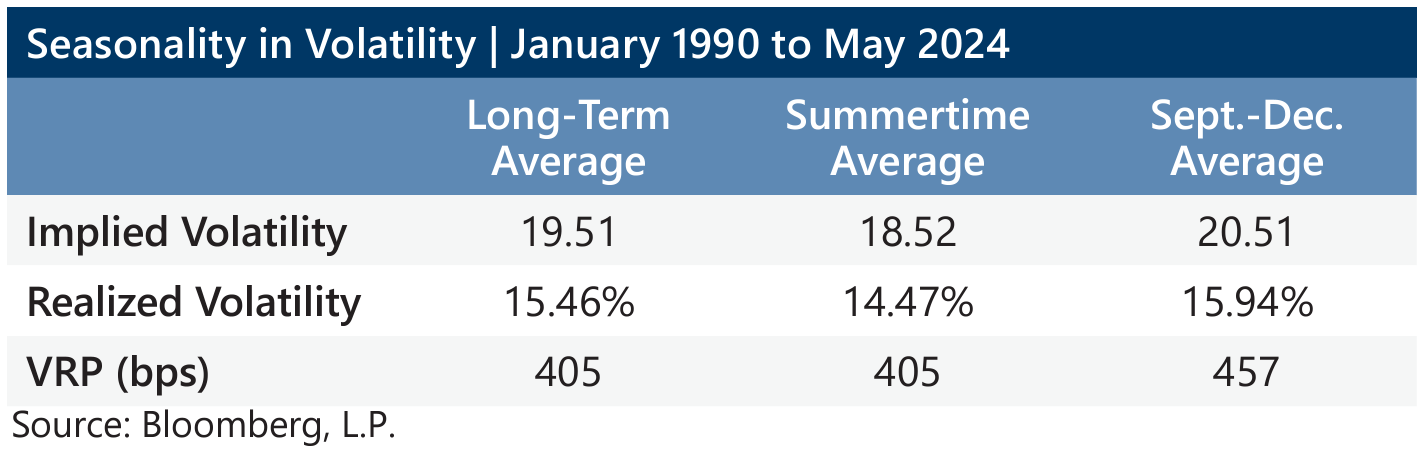

On a monthly basis since inception of the Cboe® Volatility Index (the VIX®) in January 1990 through May 2024, realized volatility of the S&P 500® Index has averaged 15.46% while the VIX® has averaged 19.51. When isolating the three summer months of June, July, and August over this timeframe, averages are roughly 1% lower than the long-term averages. Over this time, realized volatility averaged 14.47% and the VIX® averaged 18.52. The VIX® has historically reached its summertime lows in July, which averaged 17.84.

On a monthly basis since inception of the Cboe® Volatility Index (the VIX®) in January 1990 through May 2024, realized volatility of the S&P 500® Index has averaged 15.46% while the VIX® has averaged 19.51. When isolating the three summer months of June, July, and August over this timeframe, averages are roughly 1% lower than the long-term averages. Over this time, realized volatility averaged 14.47% and the VIX® averaged 18.52. The VIX® has historically reached its summertime lows in July, which averaged 17.84.

Summer Is Not Forever

The season may have started early in 2024. Although not captured in this summertime analysis, as the U.S. Memorial Day weekend settled in – an unofficial start to summer – the VIX® reached an intra-month low of 11.86 in May 2024. It has not been at such a low level since 2019.

Adding credence to a history of sleepy summers is that realized volatility for the remainder of the year (September through December) averaged 15.94% while the VIX® averages 20.51. This represents more than a 10% increase from summer levels, with a 199 basis points (bps) increase in the VIX® and 147 bps increase in realized volatility.

Adding credence to a history of sleepy summers is that realized volatility for the remainder of the year (September through December) averaged 15.94% while the VIX® averages 20.51. This represents more than a 10% increase from summer levels, with a 199 basis points (bps) increase in the VIX® and 147 bps increase in realized volatility.

Though summertime is a time to unwind, investors should be leery of letting down their guard. Data suggests that there may be a high likelihood of volatility increasing later in the year, and, in 2024, there are ample potential drivers on the horizon. Since 1990, volatility has been higher after summer, from September to December, 68% of the time. While the U.S. presidential elections may, or may not, impact volatility, ongoing and potentially escalating conflicts abroad, growing domestic debt levels, and monetary policy divergence are just a few other concerns that might impact volatility.

Rest Easy

It is important that investors always remain vigilant and appropriately manage the risks in their portfolios. Since 1977, Gateway has focused on stability, risk-adjusted performance and long-term growth. The firm’s index options-based strategies have consistent risk profiles and are uniquely positioned to benefit from the current market environment of interest rates away from zero with a robust and persistent volatility risk premium, and may benefit from potential post-summer volatility levels, while offering the potential for protection during downside events and benefiting from increases in volatility.

Past Performance does not guarantee future results

Data sources: Bloomberg, L.P. and Morningstar DirectSM.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.