Not Since the 1990s

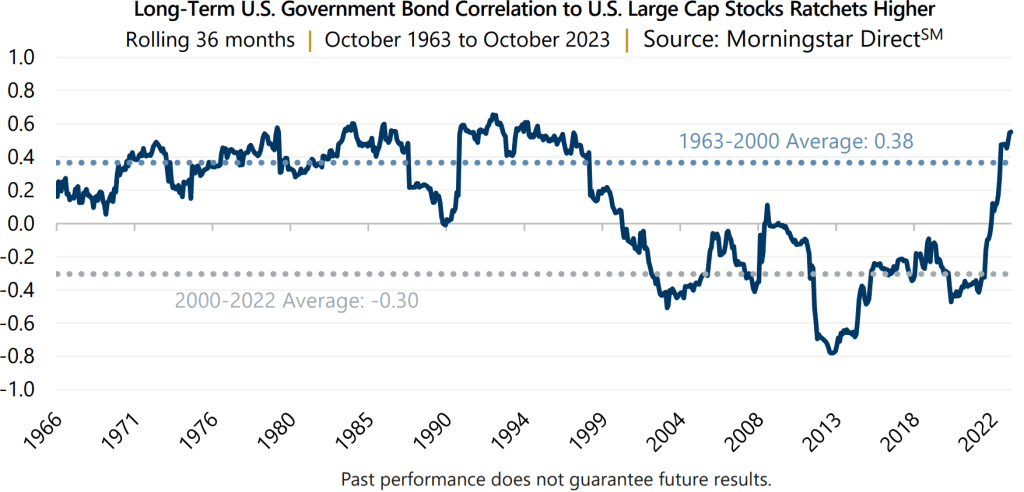

Recently, as interest rates have climbed significantly and at a rapid pace, correlation between U.S. long-term government bonds and U.S. large cap stocks reached heights not seen since 1992. To the chagrin of investors, in 16 of the last 18 monthly instances where the S&P 500® Index had a negative return, the Bloomberg U.S. Aggregate Bond Index declined alongside the equity market, or nearly 89% of the time. Interestingly, over the past 60 years, the rolling 36-month correlation between long-term government bonds and U.S. large cap stocks was positive in nearly 62% of rolling periods.

The rapidly changing market environment is in contrast with recent periods that may influence investor recency bias. For example, from July 2000 to July 2022, apart from four months during the crisis in early 2009, rolling 36-month correlation between U.S. long-term government bonds and U.S. large cap stocks was persistently and significantly negative. This suggests that declines in stocks were at least partially offset by gains in bonds, and vice versa, during the period. Unlike the current environment, the recent low-rate period may have been the anomaly as it also coincided with a period of declining interest rates that ultimately reached – and persisted – at historic lows.

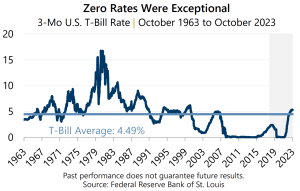

Many factors contributed to such an environment; for instance, increased globalization, stable commodity prices, and relative economic and geopolitical stability. However, the primary driver of the low interest rate environment and persistent negative correlation between U.S. long-term government bonds and U.S. large cap stocks was low and stable inflation. This was mainly achieved by coordinated global central bank stabilization efforts after the Great Financial Crisis, or what lovingly became known as quantitative easing, ‘QE,’ and zero interest rate policy, or ‘ZIRP.’

Many factors contributed to such an environment; for instance, increased globalization, stable commodity prices, and relative economic and geopolitical stability. However, the primary driver of the low interest rate environment and persistent negative correlation between U.S. long-term government bonds and U.S. large cap stocks was low and stable inflation. This was mainly achieved by coordinated global central bank stabilization efforts after the Great Financial Crisis, or what lovingly became known as quantitative easing, ‘QE,’ and zero interest rate policy, or ‘ZIRP.’

In 2022 and 2023, many of these low-rate and low-inflationary trends seemingly started to reverse themselves. Globalization is on the decline as industries are reorganizing supply chains to be more localized; commodity prices appear increasingly volatile and climbing; economic and geopolitical instability is on the rise; and massive fiscal stimulus – during and after the pandemic – is increasing inflationary pressure.

While the future is unclear, at best, many of these factors are in their nascent stages with clear potential for persistence. For instance, inflation has the potential to be sticky once embedded in the economy. When this happens, such as it did in the 1960s through late-1990s, rolling correlation between U.S. long-term government bonds and U.S. large cap stocks can remain significantly positive. This specific period included either high inflation or concerns surrounding the potential return of high inflation. The current inflationary environment failed to prove as transitory as many had initially hoped and may continue to contribute to positive correlation between bonds and stocks.

Possibly the least unclear is an increasing anticipation that interest rates may remain at new-found heights for longer than initially anticipated, which may also suggest an extended period of positive correlation between bonds and stocks. Historically, U.S. long-term government bonds and U.S. large cap stocks have been positively correlated when 3-month Treasury Bill (T-Bill) rates were within range of the long-term average of 4.49%. Since October 1963, 3-month T-Bill rates averaged 6.38% during positively correlated periods and 1.71% during periods of negative correlation.

A Timely Alternative

Interest rates are one primary factor impacting option pricing, and their recent and rapid climb enhances return dynamics for option-selling strategies. While fixed income continues to play an important role in many portfolios, investors might also consider alternatives amidst such a correlation conundrum. Investors looking to diversify may benefit from options-based strategies, which have the potential to benefit from robust levels of volatility and away-from-zero, and rising, interest rates.

For example, if current levels of interest rates remain above zero or move higher, option writing premiums can be an effective source of lower-risk return potential. Compared to levels prior to 2022, cash flow from writing a one-month at-the-money index call option has increased significantly. Elevated cash flow provides strong return potential during market advances and attractive downside protection potential in down markets. Higher interest rates also reduce the cost of purchasing protective put options, which can further enhance the cash flow and risk-adjusted return potential. Strategies employing these approaches, such as those managed by Gateway since 1977, may be well positioned in the current environment to provide investors with the potential to generate attractive risk-adjusted returns over the long-term.

Past Performance does not guarantee future results

Data sources: Bloomberg, L.P. and Morningstar DirectSM.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.