Volatility Briefing – August 2024

The culmination of international trade concerns, rough earnings reports from technology-related companies, and a disappointing U.S. jobs figure that resurrected recession worries led the S&P 500® Index to decline -6.07% from July 31 to August 5. This continued a decline from recent highs, which was interrupted by a brief rally at the end of July. From July 16 to August 5, the S&P 500® Index declined -8.45%.

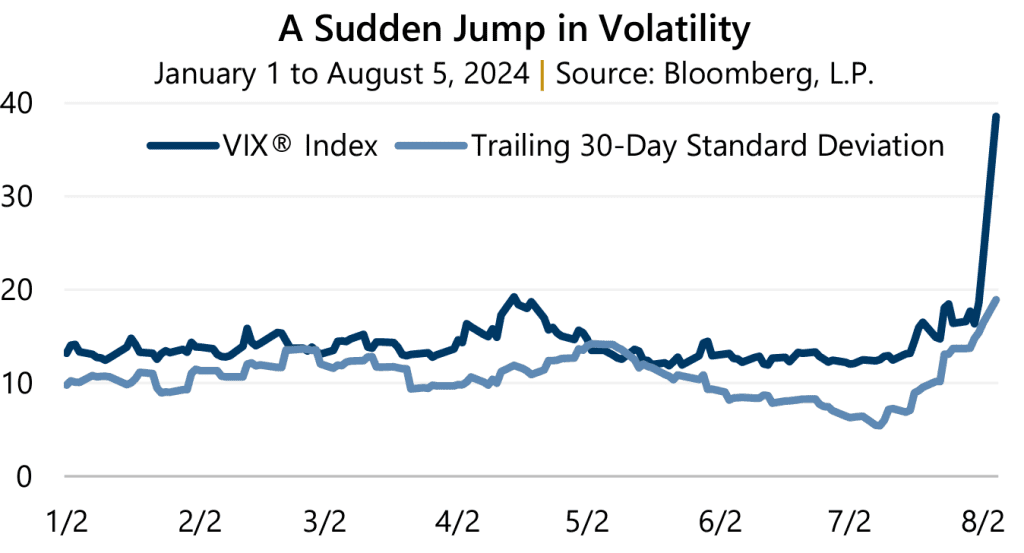

Unlike some drawdowns in which it skates through relatively subdued, volatility responded in impressive fashion in August 2024. The Cboe® Volatility Index (the VIX®), a measure of implied volatility, closed at 38.57 on August 5 – its highest level of the year and one not witnessed since October 2020. Realized volatility, as measured by the standard deviation of trailing 30-day returns, reached 18.92% which is a level not seen since January 2023 – and this was after the measure fell to 5.43% in July, a low not witnessed since November 2019.

Between July 16 and August 5, 2024, there were two trading days in which the S&P 500® Index had a move of 2% or greater. In both instances, negative. However, the July 24 decline was the first of such magnitude since February 2024 when hopes of multiple rate cuts over the course of the year faded. Investors would need to look back to February 2023 to find the next 2% or greater, move.

Long story short, things got messy, quickly.

Volatility is hard to predict, may lead to loss, often appears when unexpected, and can distract from potential opportunities. Constant vigilance is important. With investing, employing options-based strategies, such as those that Gateway has offered since 1977, can help investors navigate tumult by keeping them invested while capturing benefits of heightened volatility exactly when necessary.

Past performance does not guarantee future results.