The Highlights

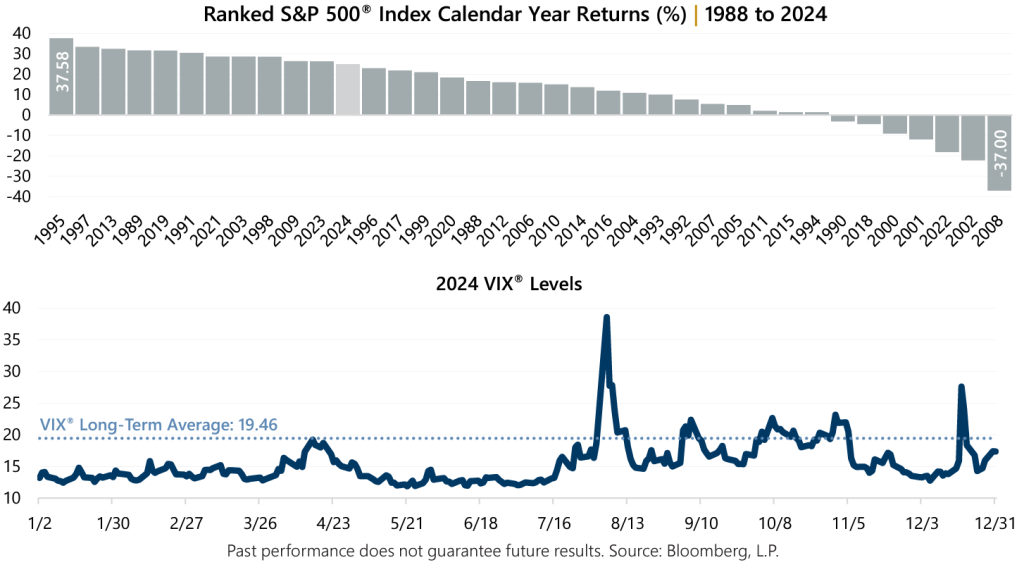

- In 2024, the S&P 500® Index achieved its first consecutive 20%+ return since 1998-1999 while the Cboe® Volatility Index (the VIX®) reached crisis-like levels, supporting options-based strategies.

- The U.S. Federal Reserve’s (the Fed) shifting policy has contributed to the normalization of interest rate and volatility levels.

- Current interest rate and volatility conditions have the potential to persist. Active options-based strategies can capitalize on such an environment, as exhibited through strong performance and improved equity market participation during 2024.

Another Notable Year

Across the spectrum, from the economy and geopolitics to artificial intelligence and space exploration, 2024 was something to remember. Investors can affectionately reminisce over a memorable year that included the VIX® reaching crisis-like levels while the S&P 500® Index booked its first consecutive 20%+ annual return since 1999. After returning 26.29% in 2023, the S&P 500® Index advanced 25.02% during 2024 which respectively rank as the 11th and 12th highest calendar year returns since 1988. This dynamic environment was beneficial to Gateway’s strategies which are designed to capitalize on volatility and the benefits of the equity market.

Driving Tailwinds

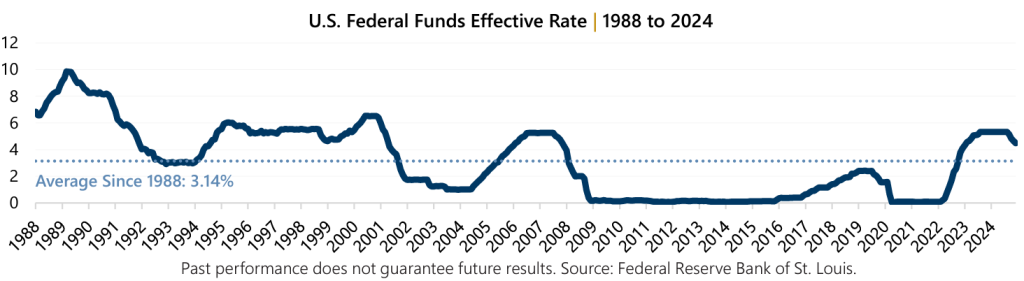

Options-based strategies have benefitted from a shift in market environment that began alongside the Fed’s transition from intense post-Global Financial Crisis (GFC) monetary easing to a tightening cycle, beginning in 2022.

One major tailwind has been the resulting rise in short-term interest rates. During the period after the GFC, 2009 through 2021, the Fed Funds rate averaged 0.52% under a ‘zero interest rate policy.’ Since the Fed began taking on a more hawkish stance in 2022, to realign record inflation with its target of 2%, Fed Fund rates have averaged 3.95%. This level is much closer to a since-1988 average of 3.14%. The Fed Funds rate peaked most recently in August, at 5.33%, before closing 2024 at 4.48% after the Fed implemented several interest rate cuts. The path of monetary policy has been a driver of equity and fixed income market performance, but shifts have also contributed to normalizing levels of volatility.

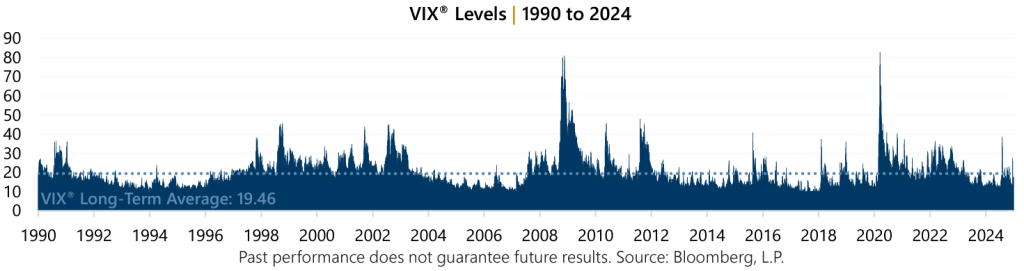

Levels of implied volatility impact index option pricing and the recent normalization has also been a tailwind to options-based strategies. The period following the GFC was heavily influenced by unprecedented quantitative easing. Central bank efforts to support financial markets revived and popularized the term ‘Fed put’ and with such supportive conditions, outside of a debt crisis here or global pandemic there, VIX® was relatively subdued for an extended period.

From 2009 through 2021, the median VIX® level was 16.80 with a low of 9.14 during the period. As the Fed began to communicate a shift in course during 2022, implied volatility began to normalize towards more typical and robust levels. From 2022 through 2024, the median VIX® level was over 9% higher at 18.35 with a low point of just 11.86 during the period – nearly 30% above the low reached during the suppressed volatility period of 2009 to 2021.

With many contributing factors in flux, including lower-but-persistent inflation and shifting geopolitical landscapes, these factors have the potential to continue through 2025, if not longer. The combination of normalized interest rates and implied volatility levels have enhanced cash flow generation potential of Gateway’s options-based strategies.

Past performance does not guarantee future results. Periods greater than one year are annualized. Data as of December 31, 2024. Sources: Bloomberg, L.P., Federal Reserve Bank of St. Louis, and Morningstar DirectSM.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.