With the recent seizure and sale of First Republic Bank, it is clear that there is still some pain in the banking industry simmering beneath the headlines; however, examining volatility levels in April may have some investors convinced otherwise. Volatility remains well above the levels seen during the prior decade although both implied and realized volatility were lower in April than one might expect, especially given the macroeconomic and geopolitical backdrop.

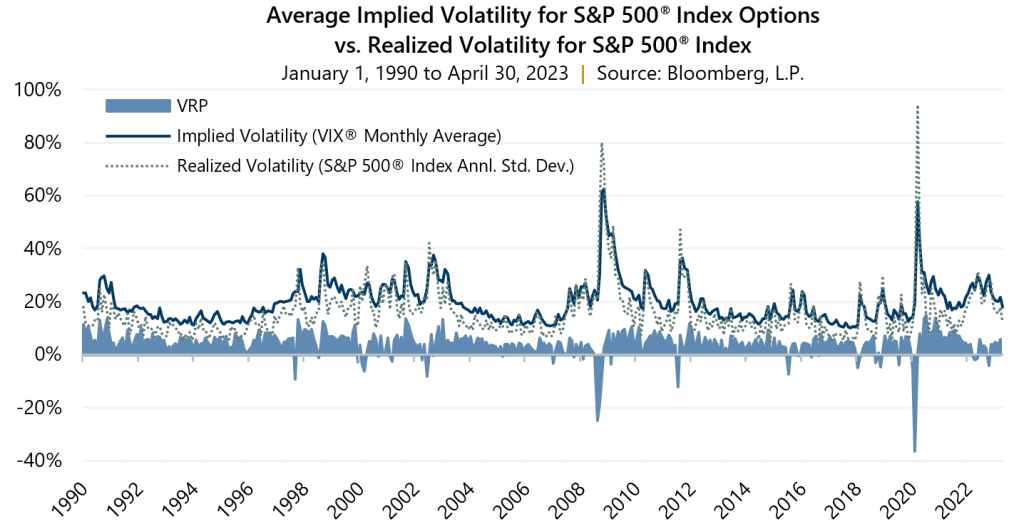

Implied volatility, as measured by the Cboe® Volatility Index (the VIX®), averaged 17.82 in April. This was the first time the measure fell below its long-term average of 19.68 in nearly two years, reaching its lowest monthly average since August 2021. Realized volatility, as measured by the standard deviation of daily returns for the S&P 500® Index, was also relatively low with an average of 11.95% for the month – its lowest monthly average since October 2021. Consistent with its typical relationship, average implied volatility exceeded realized volatility, resulting in a positive volatility risk premium (VRP). In fact, despite broad volatility levels drifting lower in April, the VRP remained well intact and above its long-term average. April’s 5.87% VRP is well above the 4.08% historical average and its highest reading since October 2021.

The frequent over-pricing of implied volatility relative to realized volatility, or VRP, represents the potential for option-writing strategies to enhance risk-adjusted return relative to broad equity market indexes. At Gateway, we believe strategies that reduce risk with index options can be an effective solution to the unique and ever-changing challenges that investors face in today’s markets. Equity market exposure combined with index options, and their associated VRP, can mitigate equity market losses while simultaneously benefitting from the equity market’s propensity to rise over the long term.

Past performance does not guarantee future results.