Volatility Briefing – October 2024

The 2024 U.S. Presidential Election is just days away and, apparently, the race is too close to call for either side to feel certain about the outcome. A reading of the tea leaves might suggest that investors are patiently awaiting election results as volatility, while robust, has remained range bound in recent weeks despite an advancing equity market. In Gateway’s world, the uncertainty that is felt by investors often reflects in the level of implied volatility being priced into index options.

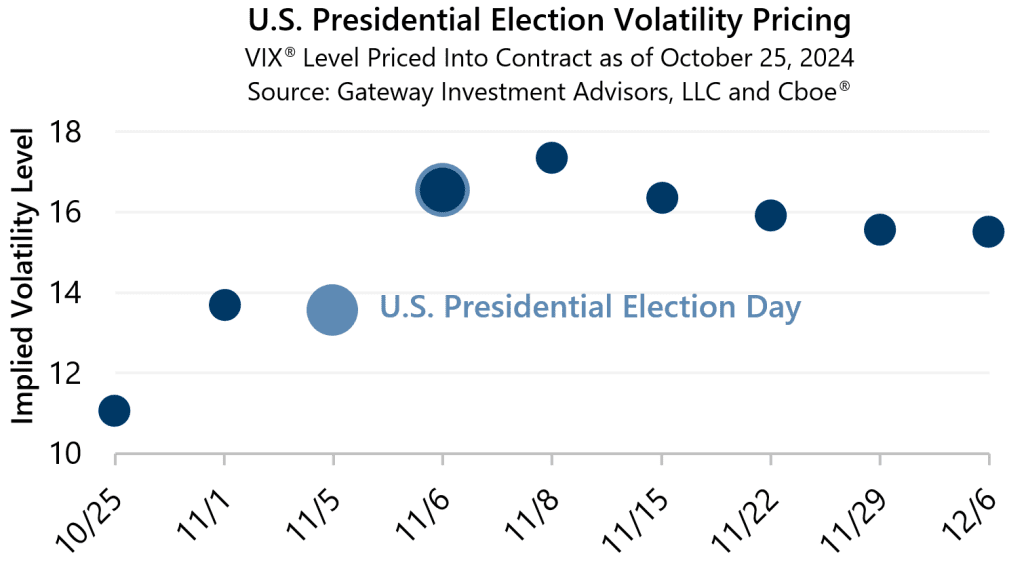

Consider the weekly S&P 500® Index option contracts listed with expirations from October 25 through election day, and beyond. A quick glance suggests volatility is expected to shift higher the very day after the election. In fact, expectations are that volatility may climb by more than 22% the very day after the election. Take a deeper look at The Election Episode for additional perspective of prior election years.

Gateway does not rely on expert predictions or expectations; however, the firm’s active approach to options-based investing should prove beneficial during times of uncertainty. Whether 2025 welcomes back President Trump or greets a President Harris, Gateway can help investors navigate the continuously changing equity market environment by harnessing the benefits from any unexpected bout of volatility so that investors feel confident about staying invested.

Past performance does not guarantee future results.