Volatility Supports Option Writing The current environment, with double-digit volatility levels and positive interest rates, has been additive to S&P 500® Index option writing strategies. These two components to option pricing have shifted significantly higher since the U.S. Federal Reserve (the Fed) began normalizing policy in 2022, after an extended period of unprecedented quantitative easing following the Global Financial Crisis. This sudden change and now uncertain path of monetary policy has resulted in higher interest rates and has been a major contributor to a more robust volatility backdrop.

The current environment, with double-digit volatility levels and positive interest rates, has been additive to S&P 500® Index option writing strategies. These two components to option pricing have shifted significantly higher since the U.S. Federal Reserve (the Fed) began normalizing policy in 2022, after an extended period of unprecedented quantitative easing following the Global Financial Crisis. This sudden change and now uncertain path of monetary policy has resulted in higher interest rates and has been a major contributor to a more robust volatility backdrop.

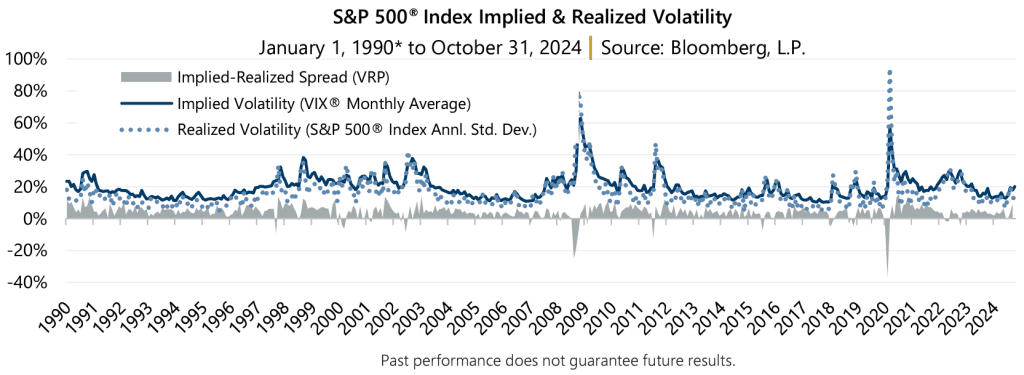

Realized volatility, that which has occurred, is often measured as the standard deviation of daily returns. In contrast, implied volatility is forward looking and often measured by the Cboe® Volatility Index (the VIX®). The spread between the two measures is referred to as the volatility risk premium, or VRP, and can be monetized by index option writing strategies such as those offered by Gateway.

The VRP exists due to consistently mispriced volatility in S&P 500® Index options. Implied volatility has generally been higher than realized and rightly so – the future is much less clear than the past. In fact, since January of 1990, the VRP has been positive 89% of the time with a monthly average of 4.1%. There are plenty of ongoing drivers of volatility such as divergence in global monetary policy and armed conflict, which may support a persistent shift higher in volatility compared to the prior decade. For instance, from January 2010 to December 2019, implied volatility, as measured by the VIX®, averaged 16.86. Nearly halfway through the current decade, from January 2020 to October 2024, the VIX® has averaged 21.59. The VIX® average since 1990 is 19.48.

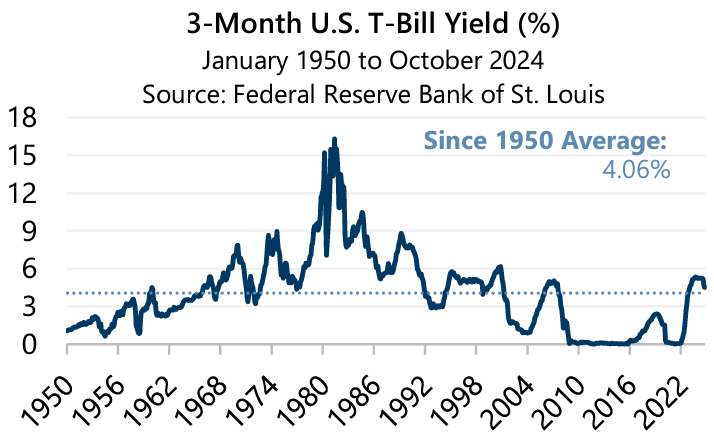

Higher Rates Also Enhance Option Writing Another current tailwind for index option writing strategies are higher short-term interest rates. With all things equal, positive interest rates can support greater cash flow generation potential. This is in stark contrast to the extended, zero-interest rate policy that was in place after the Global Financial Crisis.

Another current tailwind for index option writing strategies are higher short-term interest rates. With all things equal, positive interest rates can support greater cash flow generation potential. This is in stark contrast to the extended, zero-interest rate policy that was in place after the Global Financial Crisis.

Consider the yield on a 3-Month U.S. Treasury Bill (T-Bill) averaged 0.57% for the decade from January 2010 to December 2019. Since the start of the 2020’s, however, the 3-Month T-Bill has averaged 2.43% – 326% higher than the prior decade.

It is unlikely that short-term rates will go back to the levels seen during post-crisis quantitative easing. Even with the Fed now shifting to easing mode, short term interest rates are only expected to get down to a range of 3.5%-4.0% towards the end of 2026, based on Federal Funds Futures contracts. The average yield for 3-Month T-bills since 1950 is 4.06%, suggesting the recent tick higher in rates is simply a reversion to the mean.

Rate and Volatility Environment Boosts Results The benefits of this new environment within option writing can be witnessed in the S&P 500® Index capture results for the Cboe® S&P 500 BuyWriteSM Index (the BXMSM), going back to 1988.

The benefits of this new environment within option writing can be witnessed in the S&P 500® Index capture results for the Cboe® S&P 500 BuyWriteSM Index (the BXMSM), going back to 1988.

When the VIX® is above its long-term average of 19.65, the median upside capture ratio for the BXMSM climbs to 80%, well above the 64% upside capture experienced when implied volatility is below its long-term average.

Also, when interest rates are over 2% the median upside capture ratio for the BXMSM is 72%, an improvement relative to the 64% upside capture when rates are below 2%. Higher interest rates have also improved downside capture rates for the BXMSM. When rates have been over 2%, downside capture declines to 33% compared to 47% when interest rates reside below 2%.

Getting In

The BXMSM’s passive approach utilizes a single index option contract with monthly expiration at which time the following contract is written. This leads to performance that is a function of timing and premiums collected. In contrast, Gateway takes an active approach to managing its index option writing strategies and strives to prudently adjust a diversified portfolio of index call options to maintain consistency of market exposure in response to market dynamics. An active approach also provides the opportunity to harvest the VRP at opportune times in an effort to maximize cash flow generation. Gateway offers investors a number of opportunities to access this premium and the many other benefits of index-option based investment solutions.

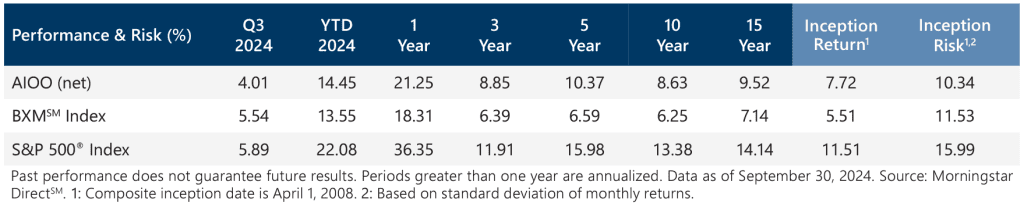

For example, net-of-fees, the Gateway Active Index-Option Overwrite Composite (AIOO) outpaced its benchmark, the BXMSM, over the trailing year-to-date, one, three, five, ten, fifteen, and since inception time periods as of September 30, 2024. The strategy also captured a majority of the S&P 500® Index return with less risk over the same time periods. A GIPS® Composite Report is included with this Commentary.

Past performance does not guarantee future results. For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.

1The BXMSM is a passive total return index designed to track the performance of a hypothetical buy-write strategy on the S&P 500® Index. The construction methodology of the index includes buying an equity portfolio replicating the holdings of the S&P 500® Index and selling a single one-month S&P 500® Index call option with a strike price approximately at-the-money each month on the third Friday of the standard index-option expiration cycle and holding that position until the next expiration.