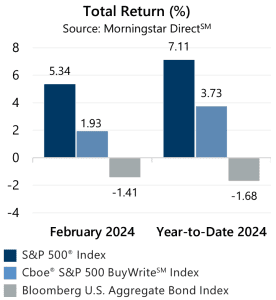

The equity market’s 5.34% rally during February led the S&P 500® Index to close the month at an all-time high. From the start of the year to February 29, the equity market has climbed 7.11%. The market’s advance has been fueled by an AI-related tech boom, but also a persistent optimism that the U.S. Federal Reserve will view its efforts to tackle runaway inflation as successful and feel comfortable enough to lower rates, potentially multiple times, during 2024.

The equity market’s 5.34% rally during February led the S&P 500® Index to close the month at an all-time high. From the start of the year to February 29, the equity market has climbed 7.11%. The market’s advance has been fueled by an AI-related tech boom, but also a persistent optimism that the U.S. Federal Reserve will view its efforts to tackle runaway inflation as successful and feel comfortable enough to lower rates, potentially multiple times, during 2024.

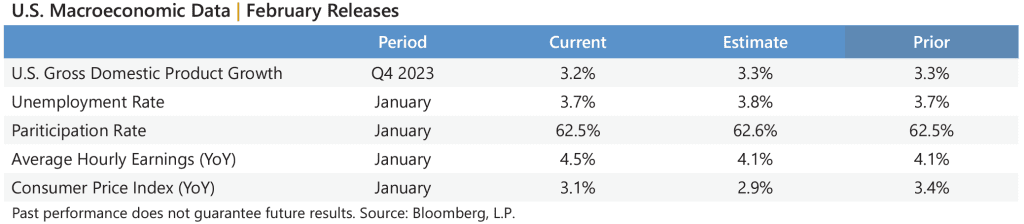

Macroeconomic data released during February showed a resilient economy and stubborn-but-softer inflation. The second estimate of Gross Domestic Product for the fourth quarter of 2023 showed a deceleration from the prior reading and just below the consensus estimate. The January Consumer Price Index released February 13 was lower than the previous reading but stubbornly above consensus estimates. Corporate earnings reflected continued resilience as well, with fourth quarter aggregate operating earnings on track to climb 1.8% quarter-over-quarter and 8.5% year-over-year. With over 96% of S&P 500® Index companies reporting, nearly 79% met or exceeded analyst estimates.

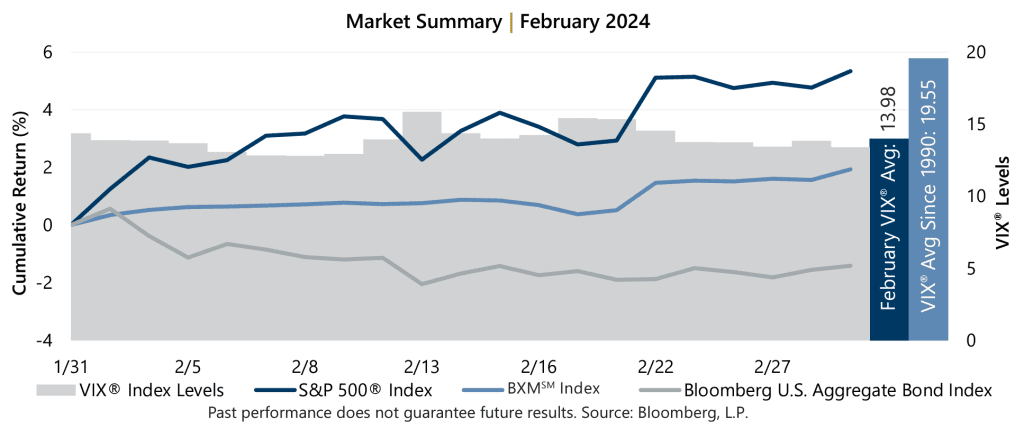

Implied volatility, as measured by the Cboe® Volatility Index (the VIX®), averaged 13.98 in February. Consistent with its typical relationship, average implied volatility exceeded realized volatility, as measured by the standard deviation of daily returns for the S&P 500® Index, which was 12.22% for the month. The VIX® ended January at 14.35 and reached an intra-month low of 12.79 on February 8 before reaching an intra-month high of 15.85 on February 13. The VIX® closed the month at 13.40.

The Cboe® S&P 500 BuyWriteSM Index1 (the BXMSM) returned 1.93% in February, bringing its year-to-date return to 3.73%. The premiums the BXMSM collected as a percentage of its underlying value were insufficient to keep pace with the rapid advance of the S&P 500® Index during the month. The BXMSM entered February with relatively low market exposure, which declined further as February’s advance began. From the start of the month through February 16, the day the BXMSM wrote its new index call option with a March expiration, the BXMSM returned 0.69% relative to the 3.41% advance of the S&P 500® Index. The BXMSM collected a premium of 1.50% when writing its new index option, but when paired with its passive positioning, was insufficient to keep pace with the equity advance over the remainder of the month. From February 16 through month-end, the BXMSM returned 1.23% while the S&P 500® Index returned 1.86%.

The BXMSM is a hypothetical S&P 500® Index buy-write strategy which purchases (buys) an equity portfolio replicating the S&P 500® Index and sells (writes) a single one-month S&P 500® Index call option with a strike price approximately at-the-money. On the third Friday of each month, the BXMSM writes a new index call option as the option it wrote the previous month expires.

This passive, rules-based approach makes the BXMSM return subject to the equity market’s path, and the premiums that the BXMSM collects on its written index call options have significant influence on its return potential.

The Bloomberg U.S. Aggregate Bond Index returned -1.41% in February, bringing its year-to-date return to -1.68%. The yield on the 10-year U.S. Treasury Note (the 10-year) ended January at 3.91% before reaching a February low of 3.88% on February 1. The yield on the 10-year then climbed to an intra-month high of 4.32% on February 22 before closing the month at 4.25%. In a historical inversion that has persisted since July 5, 2022, the yield on the 2-year U.S. Treasury Note exceeded that of the 10-year for the month.

1The BXMSM is a passive total return index designed to track the performance of a hypothetical buy-write strategy on the S&P 500® Index. The construction methodology of the index includes buying an equity portfolio replicating the holdings of the S&P 500® Index and selling a single one-month S&P 500® Index call option with a strike price approximately at-the-money each month on the Friday of the standard index-option expiration cycle and holding that position until the next expiration.

Sources: Morningstar DirectSM, Bloomberg, L.P. Performance data shown represents past performance and is no guarantee of, and not necessarily indicative of, future results.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com.