Uncertainty persists around the path of the U.S. economy despite the expected summer lull. With the Federal Reserve (the Fed) pausing rate hikes at their June 14 meeting, investors have seemingly become more comfortable with the upward trajectory of the stock market as expectations rise for a continued pause, or cut. Year-to-date through June 30, the S&P 500® Index returned 16.89% compared to its equally weighted counterpart, the S&P 500® Equal Weight Index, which has only returned 7.03% over the same period. The path and breadth of this advance has been choppy and thin, however. At the end of June, only 28% of the constituents of the S&P 500® Index had year-to-date returns greater than that of the Index. Moreover, 38% had year-to-date returns that were negative.

Meanwhile, volatility has receded in recent weeks in light of the June Fed pause and kickoff to summer. Implied volatility, as measured by the Cboe® Volatility Index (the VIX®), ended 2022 at 21.67, higher than its long-term average of 19.65. Implied volatility trended down as the market rallied and finished the second quarter at 13.59. With the VIX® futures curve on June 30 reflecting expectations of implied volatility ranging from 15 to nearly 21 into 2024, persistently elevated implied volatility may continue to be a positive contributor to option writing performance. This could potentially add several percentage points to cumulative premium over a 12-month period, compared to the average level of implied volatility for the five years prior to the pandemic.

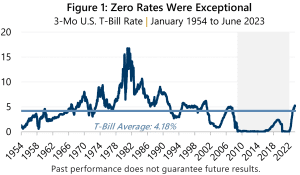

On the interest rate front, even with a rate hike pause and data releases that support a less-hawkish path forward, investors should be wary of expecting a return to the recent period of ultra-low rates which seems more an exception rather than a rule. Figure 1 looks back to 1954 and reflects the average rate on a 3-month U.S. Treasury Bill (T-Bill) as 4.18%, compared to an average of 0.47% from October 2008 to December 2021. The 3-month T-Bill ended June 2023 at 5.17%.

On the interest rate front, even with a rate hike pause and data releases that support a less-hawkish path forward, investors should be wary of expecting a return to the recent period of ultra-low rates which seems more an exception rather than a rule. Figure 1 looks back to 1954 and reflects the average rate on a 3-month U.S. Treasury Bill (T-Bill) as 4.18%, compared to an average of 0.47% from October 2008 to December 2021. The 3-month T-Bill ended June 2023 at 5.17%.

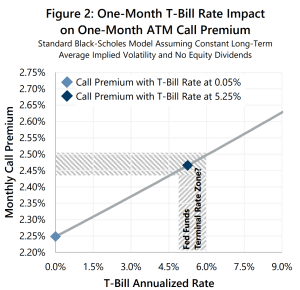

As Figure 2 illustrates, when the one-month T-Bill rate is at 0.25%, as it was for so long and so recently, the premium that investors receive for writing one-month at-the-money (ATM) S&P 500® Index call options was around 2.25%. That same call option today is generating nearly 2.50%, and if the Fed does not return a zero-interest rate policy, the interest rate component of option writing strategies could persistently and positively contribute to return moving forward. Additionally, interest rate risks typically associated with fixed income investments may be avoided – offering an alternative that may complement investors allocations to bonds.

As Figure 2 illustrates, when the one-month T-Bill rate is at 0.25%, as it was for so long and so recently, the premium that investors receive for writing one-month at-the-money (ATM) S&P 500® Index call options was around 2.25%. That same call option today is generating nearly 2.50%, and if the Fed does not return a zero-interest rate policy, the interest rate component of option writing strategies could persistently and positively contribute to return moving forward. Additionally, interest rate risks typically associated with fixed income investments may be avoided – offering an alternative that may complement investors allocations to bonds.

Like a sprinter who is now running a marathon, a lot remains to be seen regarding continued market breadth expansion, monetary policy and the economy. Investment strategies that combine equity market exposure with positive net cash flow, like those managed by Gateway, may benefit if current levels of volatility and interest rates persist, or move higher, as elevated cash flow from option writing premiums are an effective source of lower risk return potential as well as downside protection.

Like a sprinter who is now running a marathon, a lot remains to be seen regarding continued market breadth expansion, monetary policy and the economy. Investment strategies that combine equity market exposure with positive net cash flow, like those managed by Gateway, may benefit if current levels of volatility and interest rates persist, or move higher, as elevated cash flow from option writing premiums are an effective source of lower risk return potential as well as downside protection.

Past performance is no guarantee of future results.

Data sources: Bloomberg, L.P. Federal Reserve Bank of St. Louis, and Morningstar DirectSM.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.