Half Full

Investors familiar with options-based strategies may also be familiar with the Cboe® S&P 500® BuyWriteSM Index1 (the BXMSM), which represents a covered call writing approach. There are many approaches to covered call writing, but the BXMSM represents a passive and rules-based approach. Specifically, on the third Friday of each month, the BXMSM writes a new at-the-money (ATM) S&P 500® Index call option as the option it wrote the previous month expires. The passive approach results in potential returns that are significantly influenced by the path of the equity market and the premiums collected on its written index call options.

A lesser known relative of the BXMSM is the Cboe® S&P 500 Half BuyWriteSM Index2 (the BXMHSM), which is similar in design to the BXMSM except that the BXMHSM writes half a unit of an ATM index call option (covering half the notional value of the underlying stock portfolio). The BXMSM, on the other hand, writes a full unit (covering the full notional amount of the underlying stock portfolio).

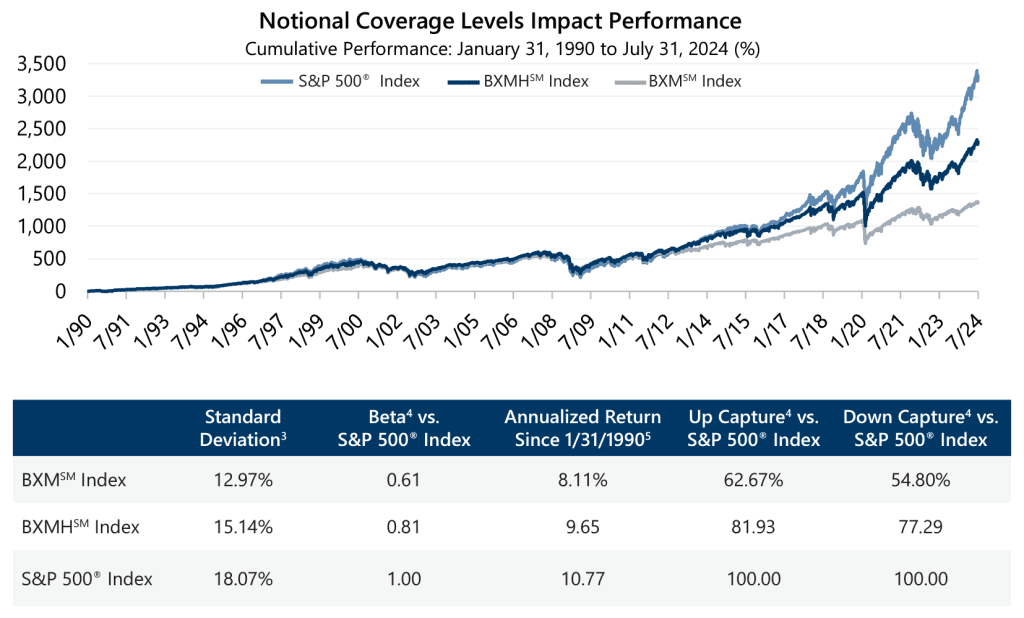

The notional coverage of a covered call writing strategy is important for investors to explore and fully understand before investing. 50% notional coverage versus full coverage changes the strategy profile and increases market exposure. This can lead to improved total return and upside capture but with increased risk – although still less risk than the broad equity market. Since the January 31, 1990 inception of the BXMHSM through July 31, 2024, risk was 16.70% higher while total return was 18.92% greater than the BXMSM.

Gateway’s Approach

Gateway’s Quality Income strategy is an income-oriented equity strategy seeking attractive distribution and market exposure by combining an actively managed, proprietary factor-based equity portfolio with an option selling overlay program. Quality Income’s option strategy involves writing (or selling) its S&P 500® Index call options with weekly expirations on half the notional value of the underlying high-quality equity portfolio.

Note that there are many differences between the Quality Income strategy and the BXMHSM. Specifically, the underlying equity portfolio for the BXMHSM is designed to track the S&P 500® Index whereas Quality Income offers a focus on the quality factor, which has historically been strong relative to other factors such as value, growth, minimum volatility, or high dividend.

Similar to the BXMHSM, however, Gateway’s strategy writes index call options on 50% of the notional value of the underlying equity portfolio. Reducing the hedge ratio from 100% to 50% is intended to help improve total return and upside capture, with similar expected benefits over the long-term that were highlighted above by the longer-term history of the BXMHSM.

Checking-In on Results

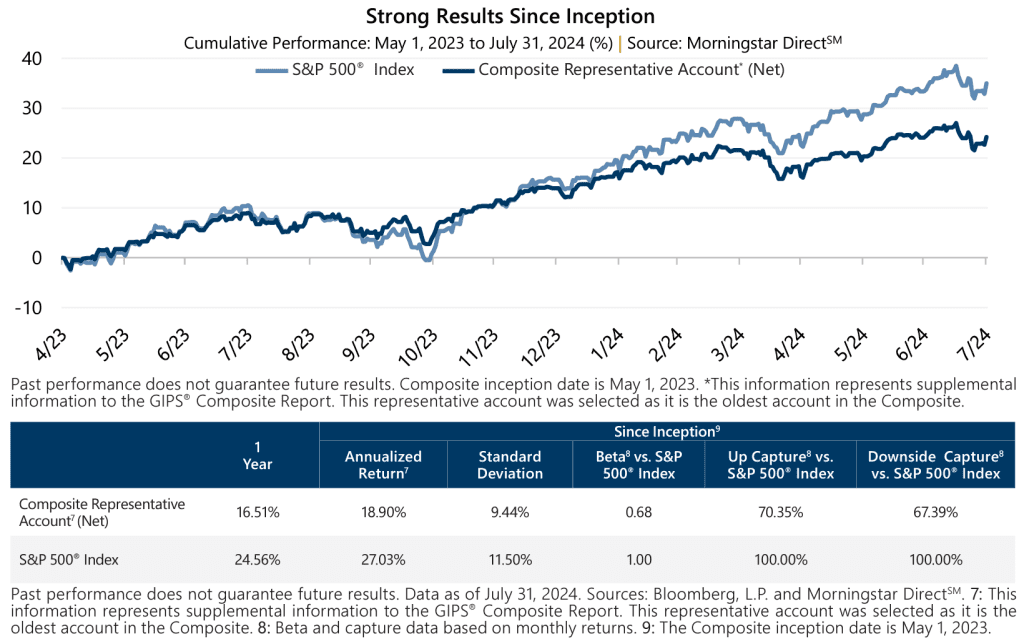

Gateway’s Quality Income Composite (the Composite) was launched May 1, 2023. A GIPS® Composite Report is included with this commentary. While looking at data through July 31, 2024 offers a small sample size, meaningful results, including strong participation with less risk relative to the broad market, have risen from the combination of investing in quality stocks and writing S&P 500® Index call options on just half the notional equity value.

Pioneers Know Best

Options-based investing can be complex, but it does not have to be. The consistent application of a disciplined, active investment management process backed by an extensively experienced team can add value for investors and improve outcomes in all environments. Since 1977, Gateway has developed a distinct expertise in quantitatively driven equity portfolio management paired with index option-based investing and currently offers a suite of products with the potential to mitigate risk and enhance risk-adjusted return.

1. The BXMSM is a passive total return index designed to track the performance of a hypothetical buy-write strategy on the S&P 500® Index. The construction methodology of the index includes buying an equity portfolio replicating the holdings of the S&P 500® Index and selling a single one-month S&P 500® Index call option with a strike price approximately at-the-money each month on the third Friday of the standard index-option expiration cycle and holding that position until the next expiration.

2. The BXMHSM is a benchmark index designed to track the performance of a hypothetical covered call strategy. The BXMHSM is similar in design to the BXMSM. However, the difference in methodology is as follows: the strategy only writes half a unit of an at-the-money monthly S&P 500® Index call option while the long S&P 500® Index position remains unchanged.

3. Data calculated using daily returns from January 31, 1990 to July 31, 2024.

4. Data calculated using monthly returns from January 31, 1990 to July 31, 2024.

5. The BXMHSM inception date is January 31, 1990.

6. Option overlay characteristics may be achieved with the use of equity-linked notes, or ELNs. Index-option and/or ELN activity provides income and reduces volatility.

Past performance does not guarantee future results. Data as of July 31, 2024. Sources: Bloomberg, L.P. and Morningstar DirectSM.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.