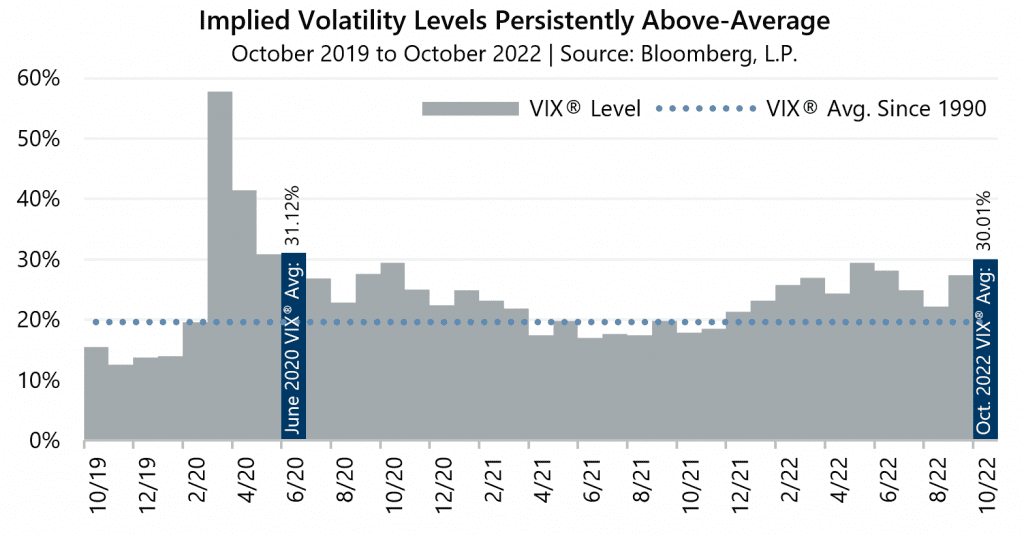

Consistent with its pattern throughout 2022, implied volatility was consistently well-above average during October, reaching its highest monthly average since June 2020. Half of the days over the first two weeks of the month witnessed equity market swings of +/- 2% or more, including an intra-day move of more than 5% on October 13, before a strong advance over the second half of the month.

The Cboe® Volatility Index (the VIX®) averaged 30.01 in October. Consistent with its typical relationship, average implied volatility exceeded realized volatility, as measured by the standard deviation of daily returns for the S&P 500® Index, which was 27.95% for the month. The VIX® closed September at 31.62 and climbed to an intra-month high of 33.63 on October 11 before drifting to its intra-month low of 25.75 on October 28. The VIX® closed the month at 25.88.

*For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.