The Federal Reserve’s (the Fed) monetary policy transition from accommodative to tightening was sudden – asset purchases to support the economy ended in March 2022, the same month the Fed began a series of rate hikes that brought the top-end of the Fed Funds rate target to 4.5% by year-end. Though the abrupt transition was preceded by months of rhetorical reiteration that the policy transition would be “data dependent” and “continue to evolve as the data evolve,” there is scant evidence that this effort at transparency and rhetorical management did anything to reduce the market volatility that typically comes with monetary tightening. If anything, it may have exacerbated it. Though monetary policy contributed to market volatility that hurt returns for both stocks and bonds in 2022, it had a beneficial impact on index option writing cash flows.

As investors weighed monetary policy risks and other risk factors including the conflict in Ukraine and China’s Zero-COVID policy, demand for index options was strong over the course of the year, setting records for trading volume and open interest. This, combined with high realized volatility, kept implied volatility elevated in 2022.

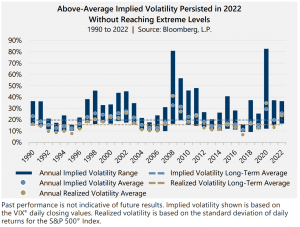

The 25.64 average level for the Cboe® Volatility Index (the VIX®) in 2022 is notable for multiple reasons: it is 30% higher than the average VIX® level since its 1990 inception, it is the sixth-highest yearly average and every year with a higher average included a volatility spike that brought the VIX® to at least 40. Conversely, the 2022 average is the highest for all years in which the VIX® remained below 40. In other words, implied volatility was persistently well-above-average without ever reaching extreme levels.

In fact, the VIX® had a higher percentage of days with readings in the 25 to 30 range than any year except 1999, another year that included multiple rate hikes and persistently above average implied volatility.

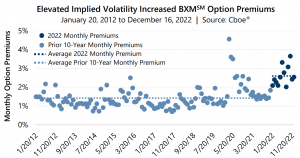

Persistently elevated implied volatility resulted in persistently elevated option premiums. For example, the one-month, at-the-money call option written by the Cboe® S&P 500 BuyWriteSM Index (the BXMSM) had an average premium of 2.60% in each month of 2022, which was more than 80% higher than the average monthly premium over the previous 10 years. Additionally, because implied volatility was so persistently elevated, the premium the BXMSM received was greater than 2% each month of the year. In fact, it was the first year in the history of the BXMSM that its premium was above 2% each month, and the current 12-month streak is second only to the 18-month streak of 2%+ premiums from mid-2008 to late 2009.

Consistent well-above-average premiums contributed to strong equity market downside protection for index option writing strategies in 2022. The BXMSM had a smaller loss than both the S&P 500® Index and the Bloomberg U.S. Aggregate Bond Index for the year, and it had a positive return in the first quarter, despite the equity market’s loss. Elevated premiums also drove strong participation in equity market advances – the BXMSM captured 90% of the S&P 500® Index’s fourth quarter rally.

Higher short-term interest rates also have a positive impact on index option writing cash flows. With the Fed indicating that its inflation fighting work is not yet complete, investors may anticipate additional rate hikes in the year to come, along with the volatility that comes with uncertainty about the Fed’s moves. Such an environment may continue to be supportive of index option writing cash flows and potentially be beneficial for low volatility equity strategies like Gateway’s that seek consistent participation in market advances and loss mitigation during market declines.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.