Higher for Longer

Higher for Longer

There has been much discussion about the aberration of the low interest rate period that prevailed throughout much of the period following the Great Financial Crisis (GFC) through 2022, when the U.S. Federal Reserve (the Fed) began loosening monetary policy. A glance at Figure 1 shows that today’s Fed Funds Effective Rate of 5.33% is much more normal and consistent with its long-term average of 4.76%.

For options-based strategies, the beneficial impact of higher interest rates is felt in the pricing of both index call and index put options. As seen in Figure 2, when the one – month T-Bill rate is 0.25%, as it was for such an extended period, the premium that investors receive for writing a one-month at-the-money (ATM) S&P 500® Index call option was around 2.25%. That same call option today is generating nearly 2.50%. If the Fed does not return to a zero-interest rate policy, which seems unlikely any time soon, the interest rate component of index option writing strategies can persistently and positively contribute to return moving forward.

The positive correlation of index call option premium with interest rates also offers investors the possibility to offset negative interest rate risks that are typically associated with fixed income investments. This offers investors a liquid and transparent alternative that can complement their allocations to bonds.

The positive correlation of index call option premium with interest rates also offers investors the possibility to offset negative interest rate risks that are typically associated with fixed income investments. This offers investors a liquid and transparent alternative that can complement their allocations to bonds.

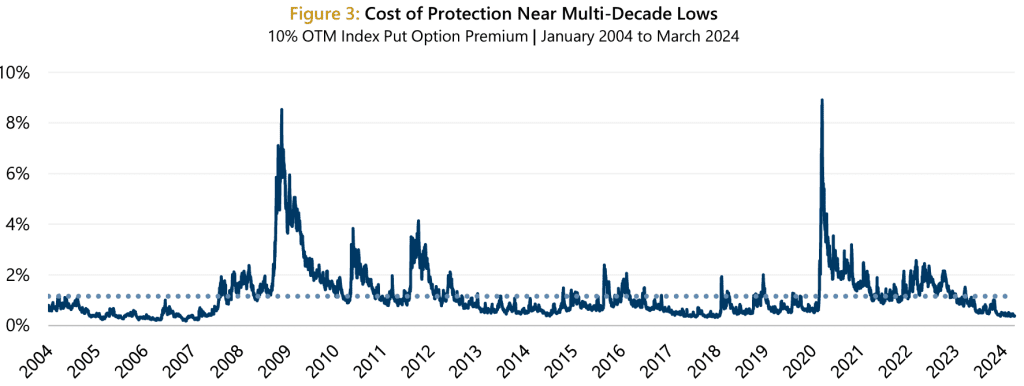

Finally, as demonstrated in Protection for Less, higher short-term interest rates (all other factors equal) results in a lower cost of protection through the purchase of index put options – which declined in price dramatically in 2023. As Figure 3 shows, the cost of a three-month 10% out-of-the-money (OTM) S&P 500® Index put option is at some of the lowest levels since January 2004. In fact, as of the end of the first quarter of 2024, the cost of such protection was just 0.38%, ranking in the 9th percentile and well below the January 2004 to March 2024 average of 1.15%.

Looking Into Results

Looking Into Results

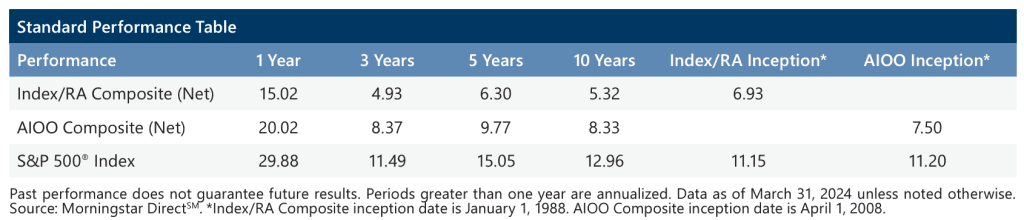

Expectations vs. Reality, published in January 2024, explored the impact of higher interest rates on performance in light of 2023 being the best year in 25 years for the Gateway Index/RA composite (Index/RA) and the best year for Gateway’s Active Index-Option Overwrite (AIOO) composite since its 2008 inception. The beneficial impact of higher interest rates can be seen further in ranking rolling 12-month returns by the level of interest rates. Given its longer track record, beginning January 1, 1988, consider the results for Index/RA:

- After ranking rolling 12-month returns by level of interest rates, median upside and downside capture ratios are drastically different when compared to periods with rates over 3% versus under 3%.

- The rolling 12-month median upside capture ratio was 66% higher during periods with short-term interest rates 3% or greater compared to periods with rates less than 3%, when the median upside capture was 39.7%.

- Downside capture was even more impressive. With rates 3% or greater, the 12-month rolling median downside capture is nearly zero compared to 31.7% when rates are under 3%.

Gateway avoids the crystal ball, but history suggests that interest rates are now in a more typical range and much closer to historical averages than compared to levels experienced during quantitative easing. For options-based strategies, this has been a game changer in terms of improved performance and capture ratios – setting the stage for an exciting future. These strategies, such as those managed by Gateway, offer investors a straightforward alternative and a compelling complement to both equity and bond allocations.

Past Performance does not guarantee future results

Data sources: Federal Reserve Bank of St. Louis, Bloomberg, L.P., Morningstar DirectSM.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.