The Quality Factor

The Gateway Quality Income strategy seeks to provide equity market participation and consistent income with reduced risk using two components. The first component is to invest in a portfolio of high-quality stocks that focus on high profitability, strong cash flow generation, and earnings quality along with strong balance sheets and low leverage. The second component, which is responsible for a majority of the income, is an option overlay on 50% of the portfolio’s assets using one-month near-the-money S&P 500® Index call options.

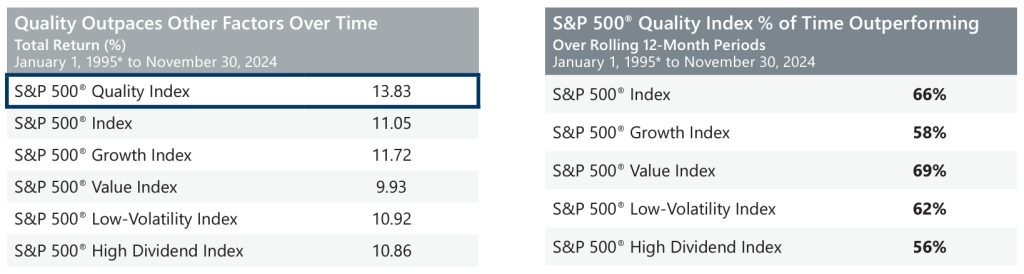

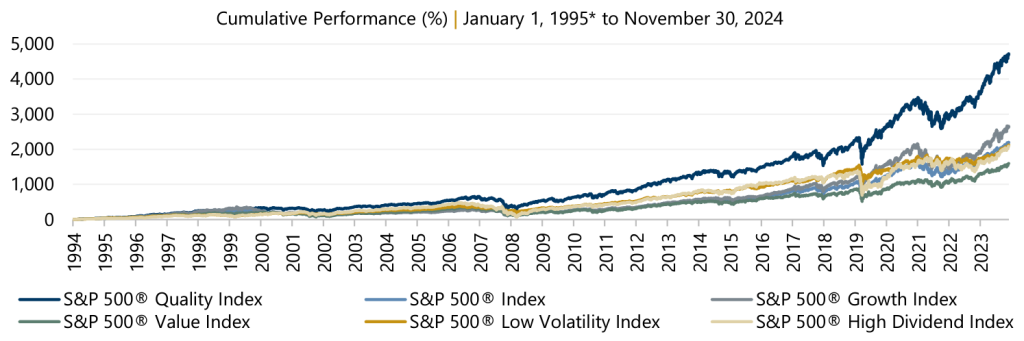

As the strategy reaches new milestones within a relatively short track record, it might be beneficial to reflect on the power of investing in high-quality stocks. A stroll down memory lane leads one to The Quality Factor, which examined the relative performance of the quality factor to growth, value, and the broad market. Quality Matters added the high dividend and low-volatility factors into the mix. Results suggested the quality factor can offer improved outcomes over time and serve investors through all types of market environments.

Checking in as of November 30, 2024 shows quality, as measured by the S&P 500® Quality Index, has outperformed all of these factors, as measured by their respective S&P 500® index, for nearly 30 years.

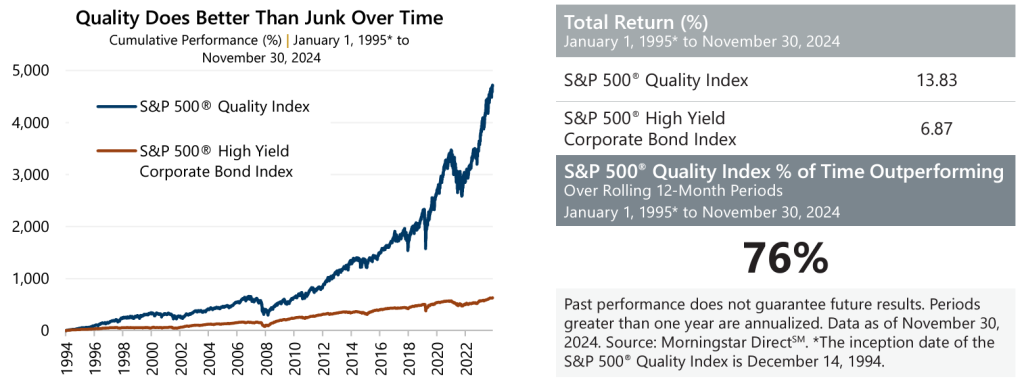

Quality Complements Junk

While potentially a complement to any equity allocation, Gateway’s Quality Income strategy can also be used as a complement to credit, specifically allocations to high yield bonds, also known to some as junk bonds. The quality factor offers a diversified return stream and has outpaced high yield, as measured by the S&P 500® High Yield Corporate Bond Index, over a roughly 30-year period.

However, a key component when complementing a high yield allocation is, well, continuing to deliver on yield. Gateway’s Quality Income approach seeks to deliver a targeted yield of 7-12% annually and is mainly driven by option incomei. Option-based cash flow offers many benefits relative to fixed income, particularly high yield, such as income without being directly tied to interest rate risk. Option premiums can also contribute to returns and offer downside protection during periods of volatility. In contrast, income from a high yield allocation might be delivered at varying levels and may be linked to lower quality companies that may find it more difficult during an economic downturn.

Current Environment Supports Option Writing

While the U.S. Federal Reserve has reduced rates during its most recent meetings, the monetary policy environment remains drastically different than the post-Great Financial Crisis era of quantitative easing. Interest rates are now closer to long-term averages, and the shift higher continues to contribute to higher implied volatility levels, as well. This backdrop is expected to persist and may continue to be favorable for option writing strategies, such as those Gateway employs, as higher levels of interest rates and volatility contribute to higher premiums.

Normalized Rates Are Supportive of Option Pricing

- Despite expectations of further interest rate cuts through the end of 2026, estimates suggest rates on 3-month U.S. Treasury Bills may only drift to a low of 3.6%. This aligns more closely with the since-1954 average of 4.2%.

- Such levels are more likely to persist rather than a return to the post-crisis ‘zero interest rate policy’ given what has been a resilient economy and lower-but-stubborn inflation.

Normalized Levels of Volatility are Supportive of Option Pricing

- Shifting monetary policy also contributed to the normalization of volatility. With many potential drivers including unclear expectations of monetary policy, shifting fiscal policy, and ongoing global conflict, volatility is likely to remain.

- The volatility risk premium (VRP), or the difference between implied and realized volatility, is persistent and robust. Since January 1990, monthly VRP has been positive 89% of the time and averaged 4.1% over the full period ending November 30, 2024.

Quality Pairs Well with Income

Since 1977, Gateway has developed a distinct expertise in quantitatively driven equity portfolio management and index option-based investing. The Quality Income strategy seeks to employ this experience to deliver consistent long-term growth through a portfolio of high-quality, durable companies and robust optionsbased monthly income. This approach offers benefits to investors through many portfolio applications:

Whether searching for a diversified return stream or additional sources of cash flow, the Quality Income strategy could benefit investors not only as an equity allocation but also as a complement to credit. Those with allocations to high yield, specifically, should consider Quality Income as a high-quality source of income.

i The same level of exposures as the listed options market may also be achieved using equity-linked notes (ELNs). The index-option and/or ELN activity provides income and may reduce volatility. ELNs are investment products structured as notes that are issued by counterparties, including banks, broker-dealers, or their affiliates. ELNs are designed to offer a return linked to certain economic characteristics and can be used within a fund structure. The typical ELN used in a vehicle such as an exchange-traded fund (ETF) is purchased at a full nominal amount and includes a coupon with a distributed yield and delivers a return profile to the underlying vehicle based on the ELN’s specified economic characteristics.

Past performance does not guarantee future results. Periods greater than one year are annualized. Data as of November 30, 2024. Sources: Bloomberg, L.P., Federal Reserve Bank of St. Louis, and Morningstar DirectSM. *The inception date of the S&P 500® Quality Index is December 14, 1994. The S&P 500®Quality Index is representative of one approach to quality investing, though differs from the methodology employed in Gateway’s Quality Income strategy and does not employ options.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.