Factored In

In the world of investing, factor investing is a well established tool for diversification. However, many investors often focus on just two dominating categories: growth and value. There is continuous debate as to which is better over the long-term, yet there is one factor that gets less attention than it may deserve – quality.

Gateway has found that quality is a hallmark characteristic of durable companies with resilient business models, reflecting historical profitability and strong fundamentals with the potential to outgrow the average company over time. Specifically, quality companies tend to demonstrate stable earnings, have high return on equity and assets, consistently generate high levels of cash flow, and maintain low leverage. These stocks often offer broad market participation with potential for defense.

Standing Out Quality is timeless and relevant throughout life. With investing, a focus on quality can help investors weather diverse market environments – providing the potential to benefit from rising markets while offering potential protection during market stress.

Quality is timeless and relevant throughout life. With investing, a focus on quality can help investors weather diverse market environments – providing the potential to benefit from rising markets while offering potential protection during market stress.

Over the long-term, quality, as demonstrated by the S&P 500® Quality Index (the Index), has shown the ability to provide a standout risk and return profile relative to the broad market and other factors. The Index is designed to track high-quality stocks within the S&P 500® Index; the selections are based on quality score. The Index’s quality score for individual stocks is calculated using return on equity, accruals ratio, and financial leverage ratio. While the past cannot predict the future, the quality factor has provided robust performance and risk-adjusted returns relative to the broad S&P 500® Index, as well as standing strong amongst other popular factor-based investment approaches over time.

Quality Matters

Global markets have experienced significant changes, leading to persistent uncertainty on many fronts. In such an environment, it is increasingly important to take a holistic view of business health. Focusing on durable businesses with fortress-like balance sheets that can withstand full economic cycles, rather than focusing exclusively on valuation or yield, can add a meaningful layer of protection through times of uncertainty or market stress. For example, consider the period after the Tech Bubble in early 2000 to 2002 or during the Great Financial Crisis from 2007 to 2009. During these periods, as shown below, high-quality companies often performed better, providing a source of defense relative to the broad S&P 500® Index and ranking well among other factors.

Keeping Score

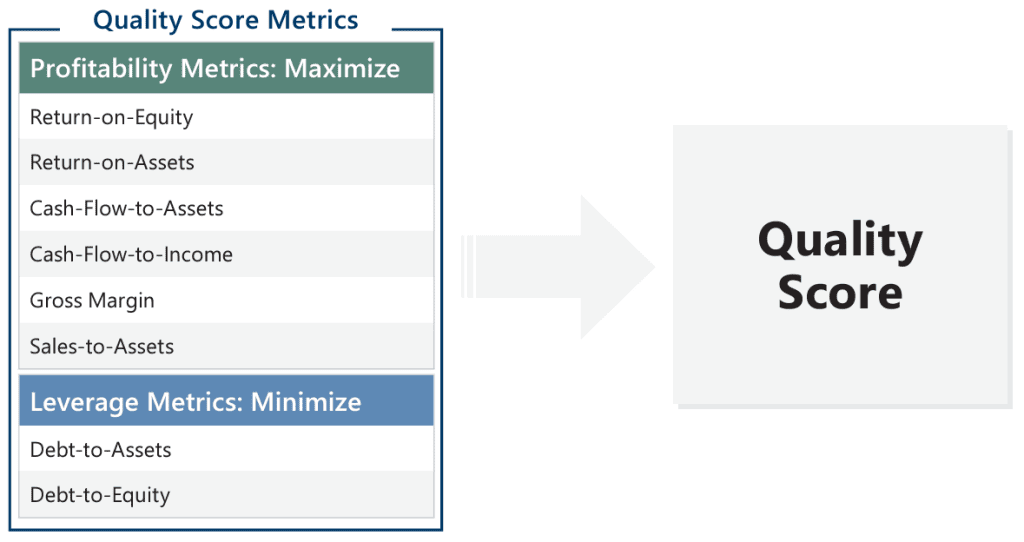

Gateway’s investment team spent significant time researching a multitude of factors and found that by emphasizing quality within an equity portfolio, investors have the potential to harness the benefits of healthy firms and balance long-term growth with defense. With an expertise in quantitatively driven equity portfolio management, the investment team identified key metrics that indicate strong, quality companies. The team developed a distinct and disciplined equity investment process aiming to increase a portfolio’s overall Quality Score which is driven by a focus on key fundamental variables.

The process results in a highly-diversified portfolio emphasizing companies with established track records of profitability and strong fundamentals while eliminating companies that are highly levered with poor balance sheets. With discretion, the team enhances the Quality Score of an equity portfolio by identifying opportunities to maximize profitablity metrics and minimize leverage metrics. For Gateway’s Quality Income strategy, this results in an equity portfolio emphasizing the highest quality names from the S&P 500® Index and relative overweightings to historically high-quality sectors.

Go for Quality

In an uncertain and chaotic world, the potential durability offered by the quality factor offers reprieve and is increasingly important for investors. The resilience of high-quality companies has shown the potential to outgrow average or lowquality companies over time, and may offer broad market participation and a source of defense during market turmoil. As the factor debate continues between the cyclicality of factors, investors may want to consider a time-tested alternative – quality.

Past Performance does not guarantee future results

Data sources: Morningstar DirectSM

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.