A combination of higher interest rates and signs of slowing growth are putting pressure on valuations. Even with February’s market pullback, the price-to-earnings (P/E) ratio on the S&P 500® Index remained at a level that would be considered extreme relative to every historical period other than the last 25 years of sky-high valuations supported by U.S. Federal Reserve (Fed) policies of rate cuts and quantitative easing. The question is, what can investors do about it?

Recently, investors have been encouraged to find comfort and shelter in the bond market where yields have climbed higher than they have been in over 15 years – and far more certain than the vagaries of the stock market. Yields have certainly climbed, but are they high enough?

Recently, investors have been encouraged to find comfort and shelter in the bond market where yields have climbed higher than they have been in over 15 years – and far more certain than the vagaries of the stock market. Yields have certainly climbed, but are they high enough?

Yields of 4% to 5% on short- to intermediate-term U.S. Treasuries look enticing, and they may offer protection if the equity market has another downturn before it finds its footing and recovers. However, even if the Fed is wildly successful in its fight against inflation and delivers its 2% target over the next two, three, or even five years, investors buying Treasury Notes today will receive real returns of 3% or less. That is better than a loss, but it will do almost nothing to repair the damage inflicted on investor portfolios in 2022.

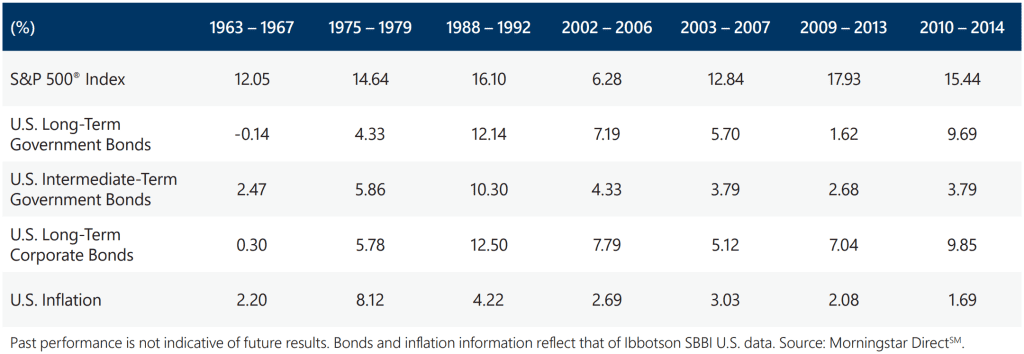

With slowing growth and valuation pressures, the equity market recovery may be facing a scenario like 2002 when valuations came down and market leadership transitioned from growth to value. In that scenario, the bear market of 2001 got much worse before it got better. In fact, in comparison to five-year periods after every bear market decline since 1950, the period of 2002 to 2006 was by far the worst. Investors were rewarded with a five-year annualized return of just 6.28% for hanging on through an additional stomach-wrenching loss of more than 33% before the equity market began its recovery. All other five-year recovery periods delivered double-digit annualized returns for investors who endured the volatility of the equity market – even the inflation plagued period of 1975 to 1979 produced strong real returns. The S&P 500® Index generated 14.64% annualized, outpacing the prodigious five-year annualized inflation rate of 8.12%.

The bond market has a mixed record on delivering meaningful inflation-adjusted returns during the five-year periods after a significant equity market drawdown. As the following table shows, after the crash of 1987, bonds delivered five years of double-digit annualized returns. The U.S. 10-Year Treasury yield dropping three-percentage points from a lofty starting point near 9%, helped bonds deliver near equity-like returns even after annualized inflation of over 4%. In the recovery periods of the 2000s, bond investments only managed to deliver low- to mid-single digit annualized returns in real terms, even though inflation was low and interest rates were stable to declining. In the 1960s and 1970s, however, rising rates and inflation resulted in real returns that were negative to only slightly positive.

The beginning of 2023 has shown investors that there is no certain path to recoup the losses experienced in both the equity and fixed income markets last year. If the goal is to recover losses incurred, investing in equities seems to offer a more opportunistic set of scenarios given the seemingly limited real return potential for fixed income in the current high-inflation environment.

For long-term investors who are willing to remain committed to equities but also have concerns that the economy may deteriorate further in the months ahead, utilizing index options for risk reduction may have appeal. Low-volatility equity strategies that rely on cash flow from index option selling to both mitigate equity market losses as well as participate in equity market advances, like those managed by Gateway since 1977, may be a suitable alternative for investors who want to reduce their exposure to bonds without increasing overall portfolio risk.

Past performance is no guarantee of future results.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.