Volatility in 2024

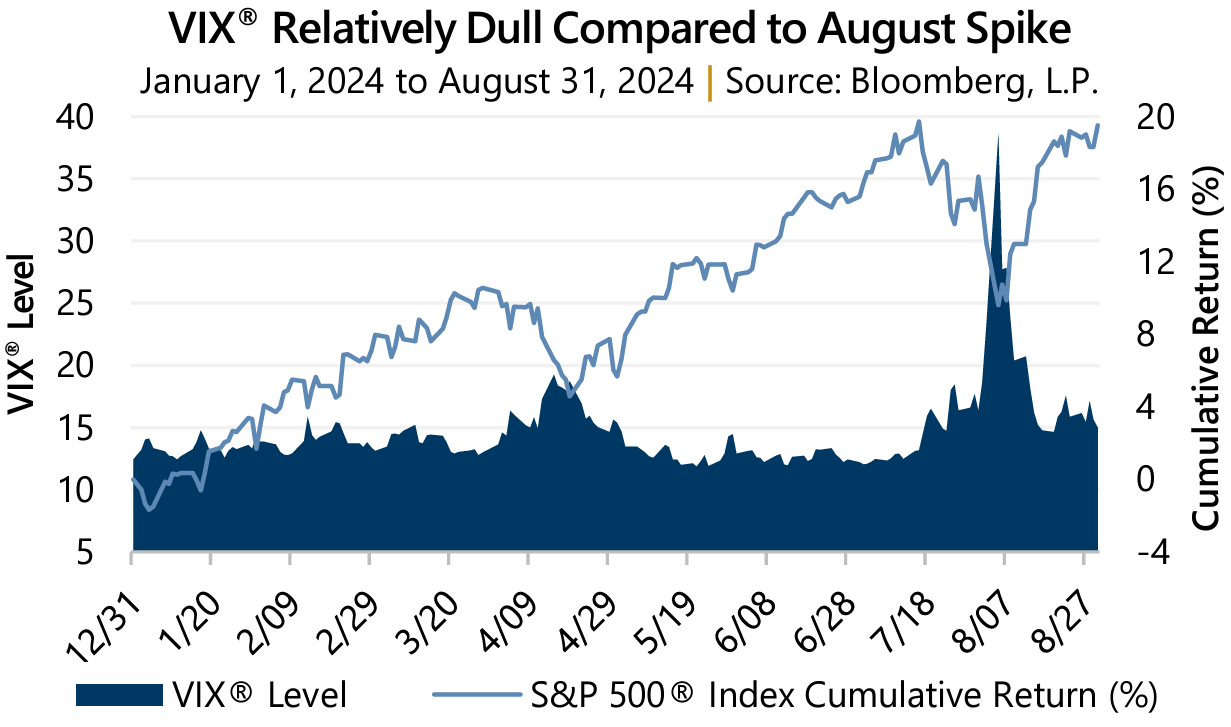

Investors following along this year witnessed higher average levels of volatility compared to the post-crisis quantitative easing era. However, until August, it was a relatively dull experience. Prior to the final month of summer, implied volatility – as measured by the Cboe® Volatility Index (the VIX®) – had only reached a high of 19.23 during April’s equity market drawdown.

Expectations that the U.S. Federal Reserve (the Fed) would achieve the multiple expected interest rate cuts were dashed at the time given a resilient economy with stubborn inflation. Investors were able to accept there was plenty of year remaining and, in line with the typical summertime pattern, volatility drifted into a subdued range. Until things suddenly changed.

Expectations that the U.S. Federal Reserve (the Fed) would achieve the multiple expected interest rate cuts were dashed at the time given a resilient economy with stubborn inflation. Investors were able to accept there was plenty of year remaining and, in line with the typical summertime pattern, volatility drifted into a subdued range. Until things suddenly changed.

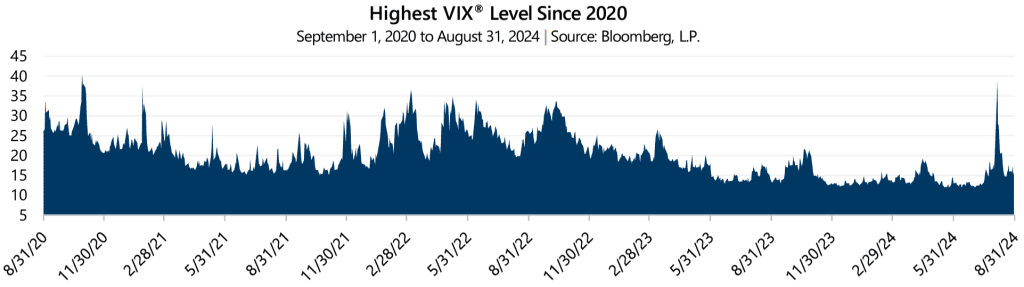

In early August the equity market was unexpectedly jolted with a new 2024 maximum drawdown and crisis-like volatility levels driven, in part, by concerns over possible recession, weak tech sector earnings, and liquidity concerns with the Japanese yen carry trade. The VIX®, which closed July at 16.36, jumped to close August 5 at 38.57 – a level not witnessed since October 2020. Summer vacation was over.

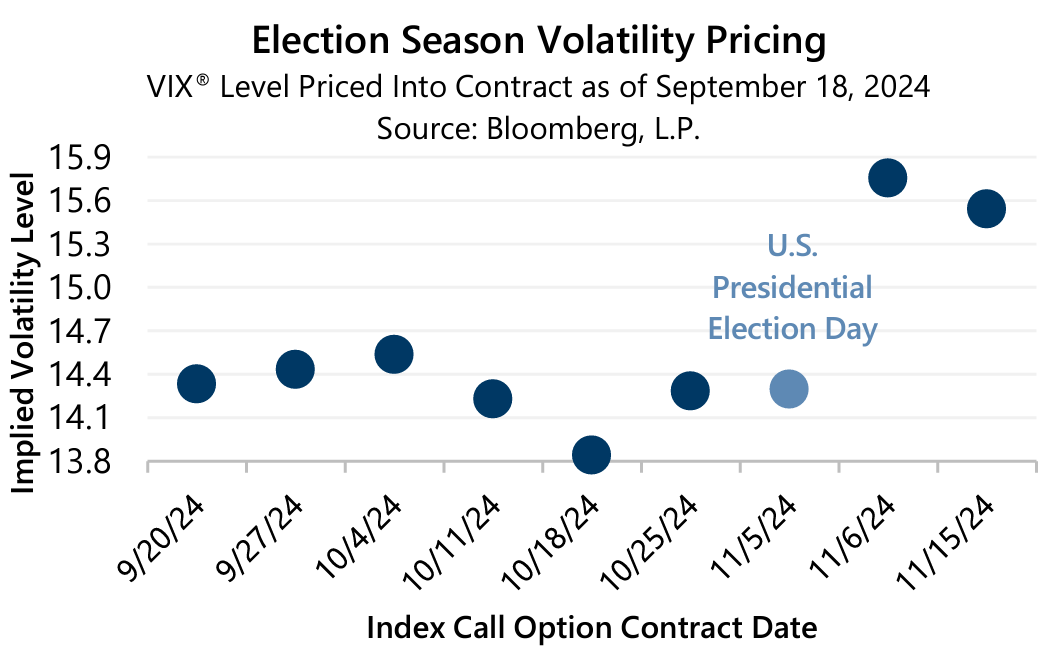

What’s Next? Gateway is not in the business of predictions but rather diligence and preparation for all environments. With armed conflicts waging in the middle east and Ukraine, growing global geopolitical uncertainty, and evolving monetary policy, the remainder of 2024 is stacked with known potential volatility events. For instance, The Election Episode explored the monthly VIX® futures curve which reflected heightened volatility surrounding the U.S. presidential election. Now, there are weekly S&P 500® Index option contracts listed until election day and beyond which suggests volatility is expected to shift higher the very day after the election.

Gateway is not in the business of predictions but rather diligence and preparation for all environments. With armed conflicts waging in the middle east and Ukraine, growing global geopolitical uncertainty, and evolving monetary policy, the remainder of 2024 is stacked with known potential volatility events. For instance, The Election Episode explored the monthly VIX® futures curve which reflected heightened volatility surrounding the U.S. presidential election. Now, there are weekly S&P 500® Index option contracts listed until election day and beyond which suggests volatility is expected to shift higher the very day after the election.

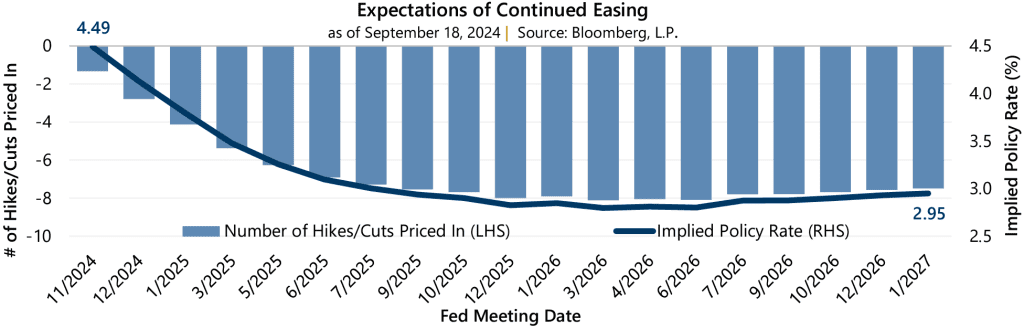

While uncertainty about conflict abroad or geopolitics could cause volatility to rise, expectations surrounding U.S. Fed Policy could be a larger force. With September’s larger-than-expected cut now behind us, there remains nearly 200 basis points of Fed Funds Rate reduction priced into the market through January 2027, with a low point in March 2026.

The Fed’s Role

Investors may often hear the phrase “Don’t Fight the Fed.” While that may or may not be sound advice, it is always worth a look at the data. With interest rate cuts now firmly on the mind of Fed officials, a revisit of Cuts Can Hurt, which explores the equity market’s reaction post-cut, may be insightful. Many view a reduction in the Fed Funds Rate as a positive sign for the equity market, but the full story is often more volatile than most would hope.

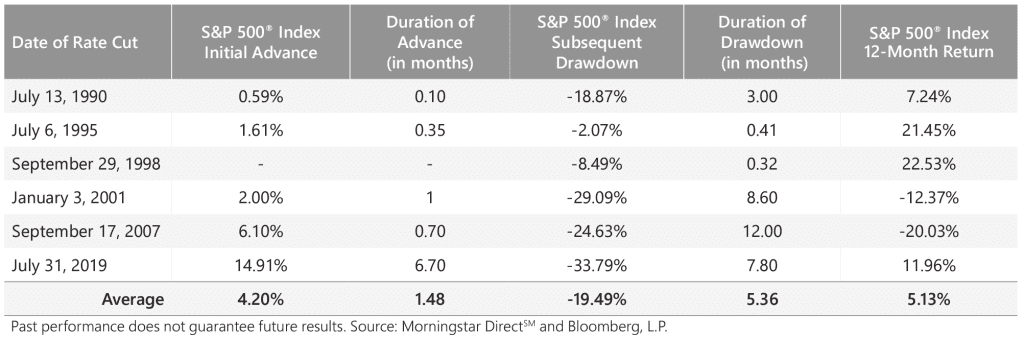

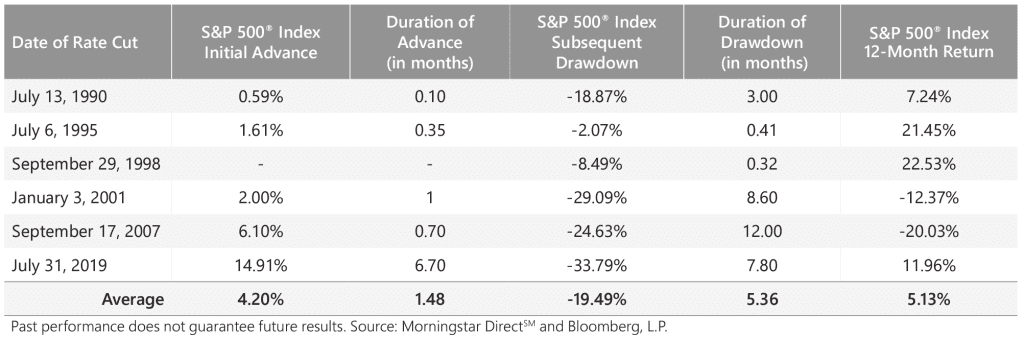

It is true that, since 1990, the market has initially advanced an average of 4.20% after the Fed began cutting rates. The average length of such a market rally is less than two months, but even 12 months after an initial rate cut, the market has advanced an average of 5.13%. However, investors should be leery of letting their guard down.

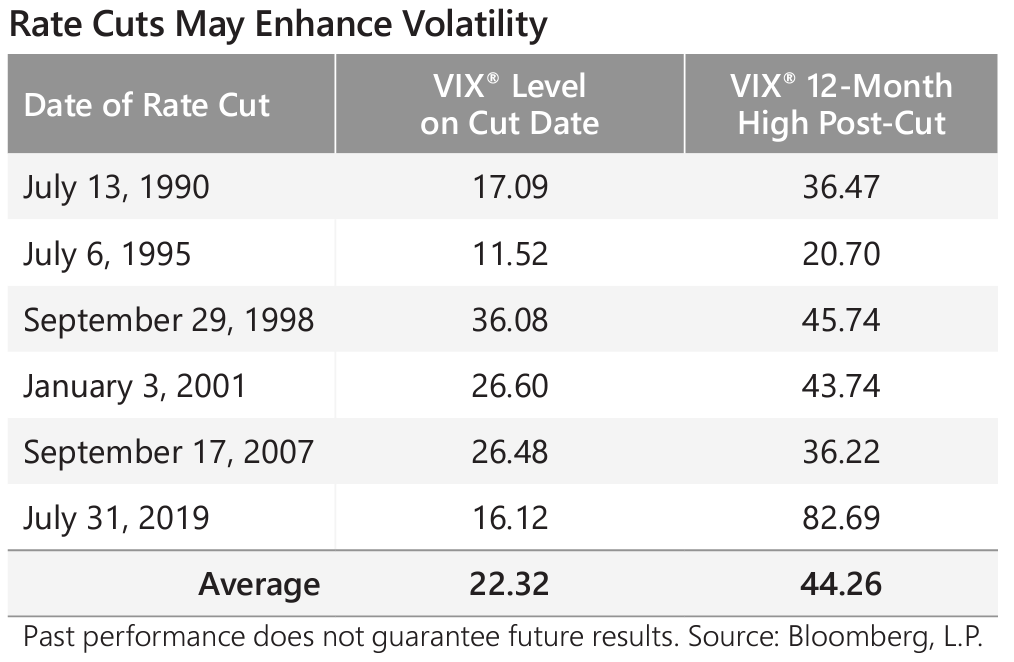

Since 1990, data shows that the equity market has experienced an average drawdown of -19.49% following a reduction in interest rates. The average drawdown duration was more than five months, but the range of duration was less than a week to twelve months. Also important to note is that in the 12 months following a rate cut, the average high closing level for the VIX® was 44.26, nearly double its level on the date of the rate cut.

Since 1990, data shows that the equity market has experienced an average drawdown of -19.49% following a reduction in interest rates. The average drawdown duration was more than five months, but the range of duration was less than a week to twelve months. Also important to note is that in the 12 months following a rate cut, the average high closing level for the VIX® was 44.26, nearly double its level on the date of the rate cut.

So, is it the rate reduction or the lagging effects of the preceding monetary tightening period that triggers volatility to climb? Some market observations point to the latter, a lagged relationship between an increase in interest rates and implied volatility.

Once the Fed begins raising interest rates, a look at the data suggests substantial and sustained increases in volatility approximately two years after interest rates were increased. Two years after an interest rate cut, when the starting point is 3% or higher, the VIX® averages 22.05. This compares to an average of 17.59 two years after a cut, when the starting point is less than 3%. The Fed began its recent bout of rate increases in late 2022.

Why the delay? The economic effects of higher interest rates are widespread, often difficult to identify, and can be significantly delayed. For instance, consider the possible chain in which higher rates might impact the economy:

- As the cost of credit increases, the availability of credit for business operations often declines.

- Higher rates may lead to a decline in consumer spending, which can dampen corporate profit margins and earnings.

- Declining corporate earnings might lead to weakened labor markets and reduced economic growth.

- Labor and growth headwinds generate recession concerns and stock market turbulence.

Market volatility rises (and the benefits of higher volatility can be captured in option prices).

Stay Vigilant

There is positive long-term potential in equity markets, albeit mired in catalysts for higher implied volatility. There are always the known unknowns, but as investors experienced in August 2024, it is unexpected volatility that can cause true derailments and require constant vigilance. Investors looking to maintain exposure to the upward potential of the equity market while benefiting from periods of stress, without stress, may want to consider the active options-based strategies offered by Gateway since 1977. Gateway’s solutions can help investors remain invested when turbulent markets arise, while harnessing the benefits of the associated and often unexpected volatility.

Past performance does not guarantee future results. For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.