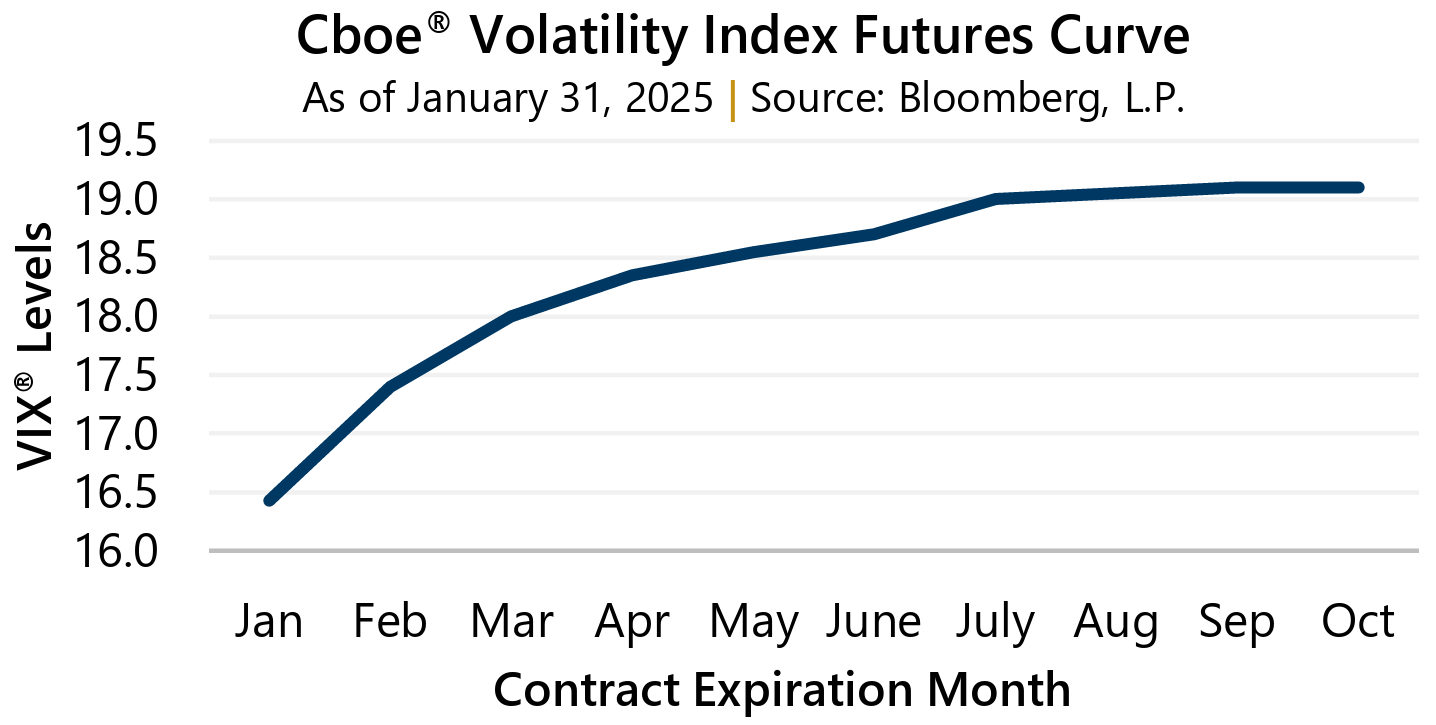

Open Tabs With the return of the Trump Administration, there is uncertainty about the potential impact of recently implemented policies and impending. Regardless of the direction taken, one could make a case that potential drivers of volatility abound. The futures curve for the Cboe® Volatility Index suggests implied volatility will climb through July, before flattening through October.

With the return of the Trump Administration, there is uncertainty about the potential impact of recently implemented policies and impending. Regardless of the direction taken, one could make a case that potential drivers of volatility abound. The futures curve for the Cboe® Volatility Index suggests implied volatility will climb through July, before flattening through October.

Tariff announcements have been the biggest headline grabber thus far in the Trump 2.0 Administration with proponents suggesting tariffs can be an effective negotiating tool and/or a strong and underutilized source of revenue. Opponents have voiced concerns that tariffs could be inflationary or negatively impact domestic economic growth by slowing down global trade or causing the U.S Dollar to become too strong.

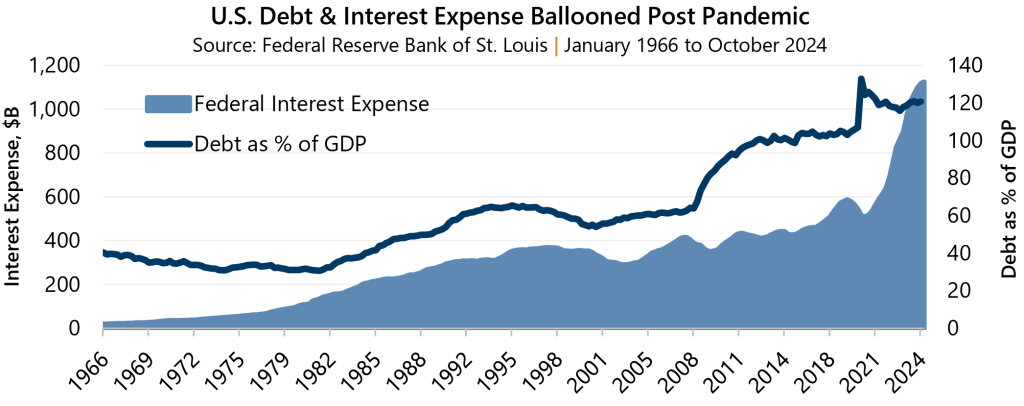

On using tariffs, one clear goal of the administration has been generating enough tariff revenue to offset domestic tax cuts. This ties into a larger picture of the fiscal situation that is being inherited. Before the pandemic, U.S. Federal Debt was $23.2 trillion. As of the end of September 2024 it stood at $35.5 trillion.

Increase in Federal Debt during a less than five-year period following the pandemic, ending at 121% of Gross Domestic Product (GDP).

Federal Debt as a percentage of GDP had ranged from 87% to 107% between January 2010 and March 2020. Over the prior 50 years, ending December 2024, Federal Debt has averaged 67% of GDP. Just like an out-of-control credit card balance, as the federal debt continued to grow and the Federal Reserve (the Fed) began to raise interest rates in 2022, interest expense for the Federal Government has more than doubled from $508 billion annually, as of September 2020, to $1.12 trillion annually, as of December 2024.

Similar to household finances, when interest payments on debt begin to outweigh principal payments, the prospect of reducing or even containing debt levels can become overwhelming. Many question the sustainability of the financial positioning of the federal government, and numerous debates amongst economists are ongoing with regards to whether higher federal deficits boost the neutral interest rate in the economy.

The neutral rate is the short-term interest rate that might prevail if the economy were at full employment with stable inflation – or, the rate at which monetary policy is neither contractionary nor expansionary. The neutral rate is not exactly observable, or set by the Fed, but rather a function of the macroeconomic environment. This perceived neutral rate is important as it helps guide the Fed on monetary policy direction. This may be one of several factors preventing the return of a low-rate era, like what followed the Global Financial Crisis (GFC).

Expense Reports

There has also been ample talk of fiscal dominance – or the point in which federal debt levels and related servicing costs are so high that the effectiveness of monetary policy begins to diminish. After a meeting on Wednesday, February 11, Fed Chairman Powell acknowledged the Fed’s limited capacity for managing long-term rates, mentioning the central bank has “some influence” but mostly has no control over longer-term rates. Fiscal dominance also has inflation implications. For instance, higher interest costs may force the Fed to lower interest rates (an inflation inducing move) even if inflation is above target while pressuring longer-term rates higher.

This could possibly be unfolding. When the Fed began cutting interest rates in September 2024, longer-term rates started to rise and remained elevated at the end of January 2025. The 10-year U.S. Treasury yield was 3.6% on September 17, 2024 when the Fed first cut rates and ended January 2025 at 4.5%. When rates increase, bond prices decrease, and vice versa. If fiscal dominance is at the doorstep and pressuring longer-term rates, the prospect for fixed income investors could be daunting.

Recent efforts under the Trump administration and the recently formed Department of Government Efficiency (DOGE) could have some hoping that reductions in excess spending will lead to a reconciling of the federal financial household and, if paired with economic growth, lead to reductions in debt and interest expense. However, there are few things certain in life and only time will tell the tale with DOGE.

All this uncertainty means that investors utilizing longer dated bonds may have limited upside potential. If inflation concerns come to fruition with current high equity valuations, the stock market may also face headwinds. Gateway’s experience navigating complex market environments since 1977 has led to compelling strategies that complement traditional 60% stock / 40% bond portfolios and can help investors navigate uncharted markets while benefiting from periods of volatility.

1Chen, V. L. (2025, February 11). *Powell says Fed has only a bit of influence over long-term yields*. MarketWatch. https://www.marketwatch.com/livecoverage/stock-market-today-dow-s-p-500-and-nasdaq-set-to-give-back-gains-with-powell-testimony-in-focus/card/powell-says-fed-has-only-a-bit-of-influence-over-long-term-yields-p7ZYy9fbeWi5gcEuytWA.

Past performance does not guarantee future results. Periods greater than one year are annualized. Data as of January 31, 2025. Sources: Bloomberg, L.P. and Federal Reserve Bank of St. Louis.

For more information and access to additional insights from Gateway Investment Advisers, LLC, please visit www.gia.com/insights.